Hello from FinBrain Technologies,

Beating the markets is becoming harder every single day for the retail traders. Hedge funds and large scale institutions have all the tools, talent and the data that can give them an edge over the others in the markets.

However, FinBrain’s team of engineers are working day and night to make the alternative datasets and AI tools accessible for the retail traders all over the world.

Our talented team members are constantly developing algorithms to create, organize and analyze the alternative financial data to spot the unusual activities and to generate alpha in the stock markets.

We have been collecting and publishing the latest company insider transactions for the largest 4500 US companies to extract actionable insights from the data.

Insider trading activity by the corporate executives and largest stakeholders are published on every single stock’s page on FinBrain Terminal.

We track the latest transactions for thousands of stock tickers and analyze the number of shares, USD value as well as the insider trader’s relationship with the company.

Recently, we have published the analysis for Dustin Moskovitz’s Asana trades and how the stock gained more than 50% within a couple of days after the CEO’s large USD amount purchase of ASAN shares.

Moving from that example, we believe keeping an eye on the largest insider transactions can signal an upward or downward move in a company’s share price beforehand.

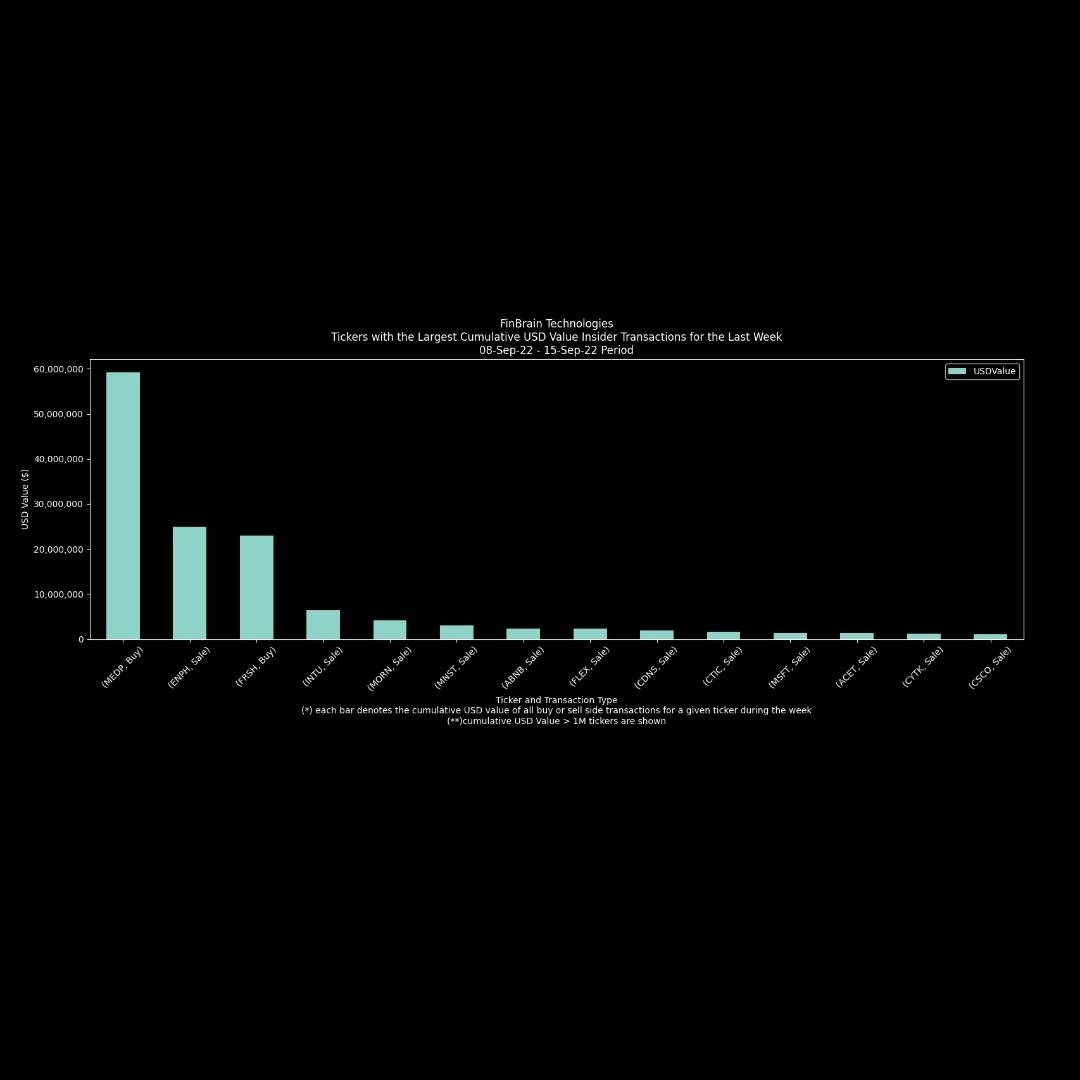

Here is the latest analysis results for the insider trading activity for a one week period between 08-Sep-22 and 15-Sep-22:

We have analyzed and visualized the cumulative USD values for all insider transactions for all available stock tickers and grouped them based on their transaction sides(buy or sell).

The chart above indicates that 13 stocks had a cumulative insider selling USD value larger than 1M, for the one week period.

Only one stock, which is MEDP – Medpace Holdings, Inc. had seen a massive insider buying activity for the given period that added up to $59.2M in total USD value.

MEDP ticker page on FinBrain Terminal indicates that the company’s CEO August Troendle and the company’s 10% stakeholder Medpace Investors, LLC have purchased the shares of Medpace Holdings during the last week.

Significant amount of purchases were made in chunks on Sep 13, Sep 12, Sep 9, Sep 8 and Sep 7 right after the company’s shares have dipped at 153.34 on Sep 6.

We can say that the company insiders have almost perfectly timed the bottom of the stock price and the company’s shares have increased up to $168.13 on Sep 12.

Insider purchasing activities by the company executives indicate their strong belief into the company’s future, hence the insider transactions dataset has a strong alpha generation and predictive ability.

All other stocks on the chart had large cumulative USD value sell transactions for the given one week period, which can be interpreted as an overall bearish signal from the company insiders.

Publicly traded company executives and large stakeholders might be thinking that their shares will be hit by the upcoming recession in the markets and they might be selling to purchase their shares back at lower prices in the future.

INTU, ABNB, MSFT and CSCO shares were also sold by the company insiders during this period, which is also noteworthy.

We will be sharing the data-driven insights with our readers to help them find an edge in the markets by leveraging the power of alternative data and we strongly encourage you to take advantage of the AI generated stock predictions and other alternative datasets on FinBrain Terminal.

We wish you a successful rest of the week.

FinBrain Technologies

99 Wall St. Suite #2023, New York, NY 10005