In the rapidly evolving world of finance, the fusion of Artificial Intelligence (AI) and Alternative Data stands out as a beacon of innovation, offering unprecedented insights into stock price movements.

A prime example of this cutting-edge approach is FinBrain Technologies’ recent forecast performance on ASML.

ASML company outlook

ASML is a leading player in the semiconductor industry, renowned for its advanced photolithography equipment that is crucial for the production of integrated circuits (ICs) or chips.

The company’s technology plays a pivotal role in enabling the miniaturization of chip components, thereby driving the semiconductor industry’s ability to follow Moore’s Law.

Based on the latest figures, ASML commands a robust market capitalization of $367.56 billion and employs a dedicated team of 39,850 professionals, underscoring its substantial influence and worth within the international technology and semiconductor industries.

FinBrain’s ASML stock forecast accuracy

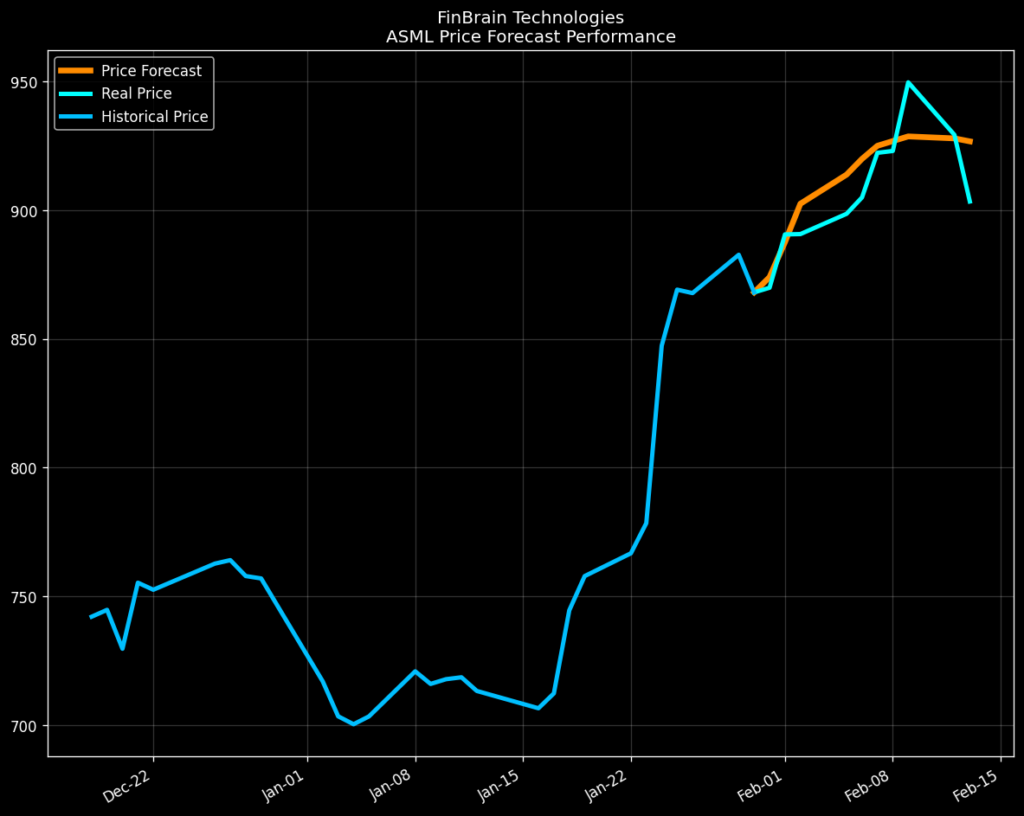

📊 For the period between January 31 and February 13, 2024, FinBrain’s AI algorithms, news sentiment data and put-call ratios forecasted the upward movement in ASML’s stock price movements with remarkable accuracy.

The predictions, made available on FinBrain Terminal before the market opened on January 31, showcased a Normalized Mean Squared Error (NMSE) of 0.526, highlighting the real price’s near-perfect alignment with FinBrain’s forecasts.

💹 Specifically, FinBrain predicted a 6.76% increase in ASML’s stock price, from an opening price of $868.03 to a forecasted $926.67. The actual price movement, closing at $903.32, reflected a 4.07% increase – underscoring the value of FinBrain’s AI in capturing market trends.

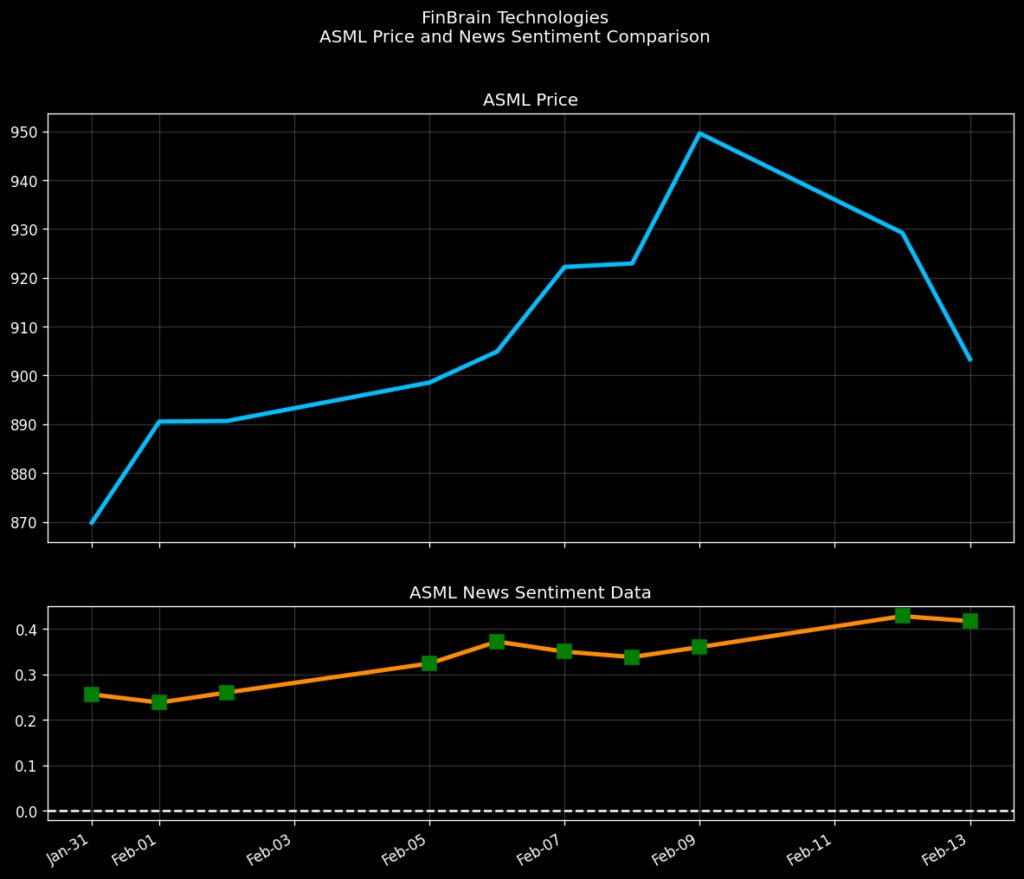

News Sentiment Data remaining in the positive territory

🔍 The insights didn’t stop there. Throughout the period, FinBrain’s news sentiment analysis for ASML remained in the positive territory, which also confirmed the bullish outlook on the stock’s price.

The news headlines for thousands of US&World stocks as well as Crypto&Foreign currencies are collected and analyzed by FinBrain’s algorithms to create the news sentiment score for a given ticker that day.

Historical news sentiment data for thousands of assets can be accessed through FinBrain Terminal and FinBrain API.

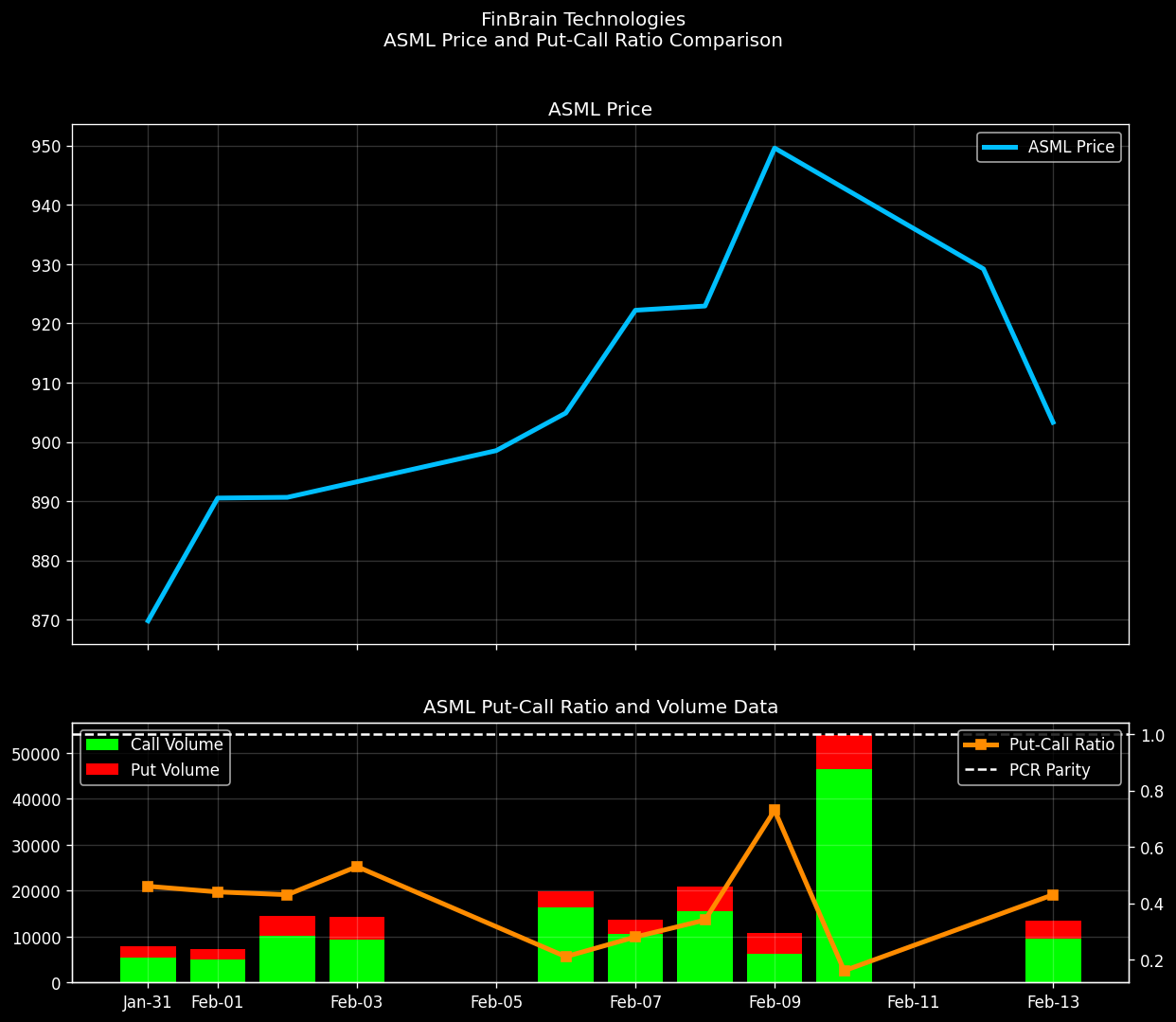

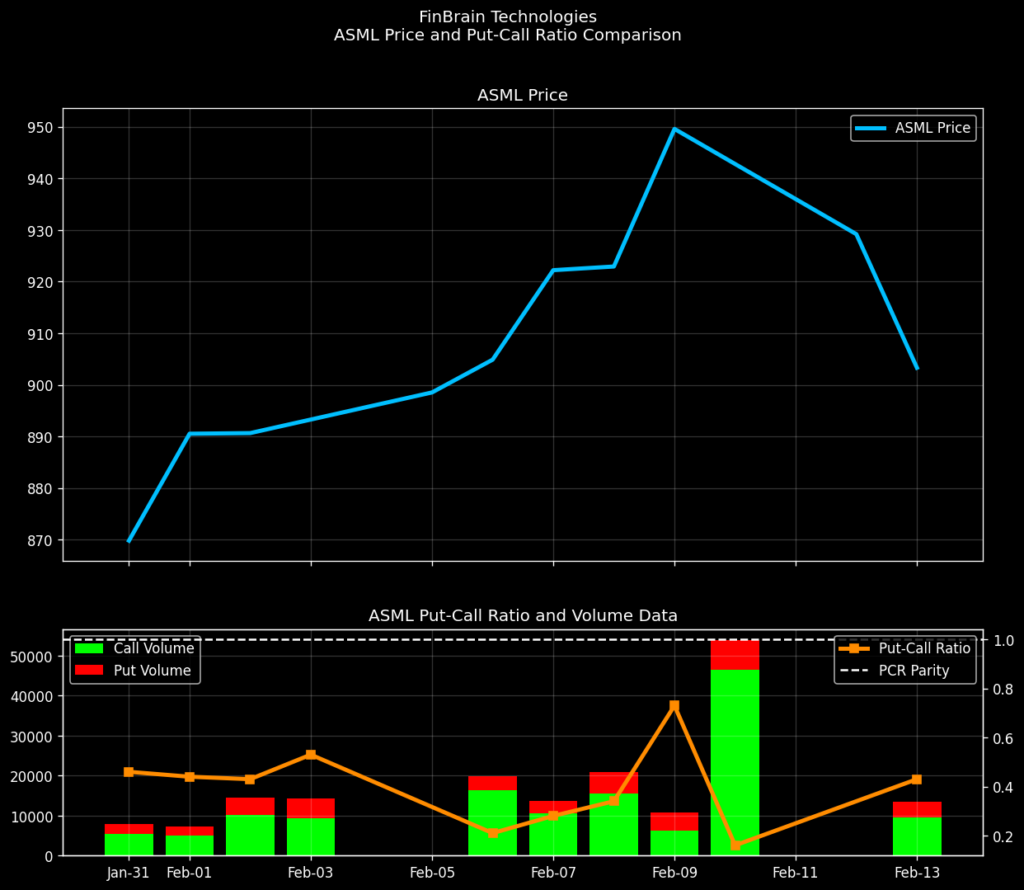

Put-call ratio data signaling a bullish expectancy

Call options were traded more heavily than the put options for the ASML stock during the given period, which signaled that the traders were bullish on the stock.

A lower put-call ratio means a more bullish outlook and the ratio staying below the parity(1) can be translated as a positive expectancy for the stock price.

The put-call ratio staying below parity further confirmed the market’s optimistic outlook on ASML, perfectly complementing the AI’s stock forecast.

Using AI models and Alternative Data in combination

This synergy of AI predictions, positive news sentiment, and bullish put-call ratios illustrates the power of integrating diverse data streams for investment decision-making.

FinBrain Technologies is at the forefront of this revolution, providing investors with a comprehensive toolkit to navigate the complexities of the stock market with confidence.

🌐 For those looking to harness these insights, we highly recommend exploring FinBrain’s Terminal and API services at FinBrain Technologies.

Dive into the world of data-driven investment strategies and discover how AI and Alternative Data can illuminate the path to informed decision-making in the financial markets.

We wish you a successful trading week.

FinBrain Technologies

www.finbrain.tech

[email protected]

99 Wall St. #2023 New York, NY 10005

Twitter • LinkedIn • Instagram • Facebook