Introduction

In the dynamic world of stock trading, the NEE stock forecast has become a focal point for investors seeking to leverage advanced analytics. NextEra Energy, a leading entity in the energy sector, presents an intriguing case study for examining the efficacy of AI algorithms and alternative datasets in predicting stock performance.

About NextEra Energy (NEE)

NextEra Energy, Inc., founded in 1984, operates in the energy sector, primarily focusing on electric power and energy infrastructure. Known for its commitment to sustainability, NextEra Energy offers a range of products and services, including clean energy generation through wind and solar. As of the latest data, the company boasts a significant employee count, reflecting its expansive operations.

NextEra Energy (NEE) stands as a strong player in the energy sector with a market capitalization of $120.17 billion, reflecting its substantial presence and investor confidence. The company’s Price-to-Earnings (P/E) ratio of 15.70 suggests a balanced valuation, potentially appealing to those looking for stable earnings growth relative to its share price.

Additionally, NEE offers an attractive dividend yield of 3.15%, a testament to its commitment to providing consistent returns to shareholders. This yield not only signifies a solid income stream for investors but also underscores the company’s financial health and its ability to maintain a steady dividend payout.

Latest News and Impact on Stock Price

NextEra Energy, a leader in the renewable energy sector, has been making headlines with several significant developments that could potentially influence its stock price. Here’s a closer look at these news items and their possible impact on the NEE stock price.

Strong Third-Quarter Results

NextEra Energy’s announcement of strong financial results for the third quarter of 2023 suggests a period of robust growth. Such positive financial health is often a precursor to stock price appreciation as it reflects the company’s operational efficiency and profitability. Investors might view these results as a signal of the company’s resilience and potential for future growth, potentially leading to increased investor confidence and a rise in stock price.

Dividend Declaration

The declaration of a regular quarterly dividend could be seen as a testament to NextEra Energy’s stable cash flow and commitment to returning value to shareholders. Dividends are a significant factor in investment decisions, and a consistent dividend payout can make a stock more attractive to investors seeking regular income, possibly driving up demand for the stock.

Advancements in Clean Energy

The significant milestone reached by Florida Power & Light Company’s clean hydrogen project marks NextEra Energy’s strides toward sustainable energy solutions. As the market increasingly favors environmentally responsible companies, this advancement could enhance NextEra’s reputation and appeal to socially conscious investors, potentially boosting the stock’s value.

AI Predictions and Alternative Data Insights

AI Stock Forecast Performance

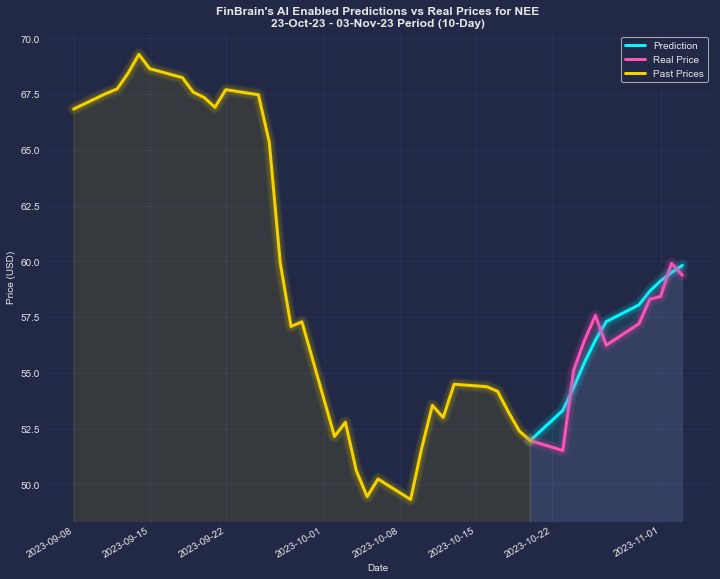

In the realm of stock market forecasting, AI’s predictive prowess has been a game-changer, particularly evident in the case of NextEra Energy (NEE). FinBrain’s AI algorithms have demonstrated remarkable foresight with their 10-day ahead predictions for NEE. The predictions, posted on the FinBrain Terminal’s NEE forecasts page before the market opened on 2023-10-23, showcased a Normalized Mean Squared Error (NMSE) of 0.497. This level of accuracy is significant, as it indicates the real stock price trajectory nearly mirrored the AI’s predictions.

Starting from a last close price of $51.96, the AI forecasted a notable rise to $59.82 by the end of the period, translating to a 15.12% increase. The actual stock price closely followed suit, reaching $59.38, which corresponds to a 14.28% rise. This close alignment between the AI’s forecast and the real stock price movement underscores the potential of AI in making informed stock market predictions.

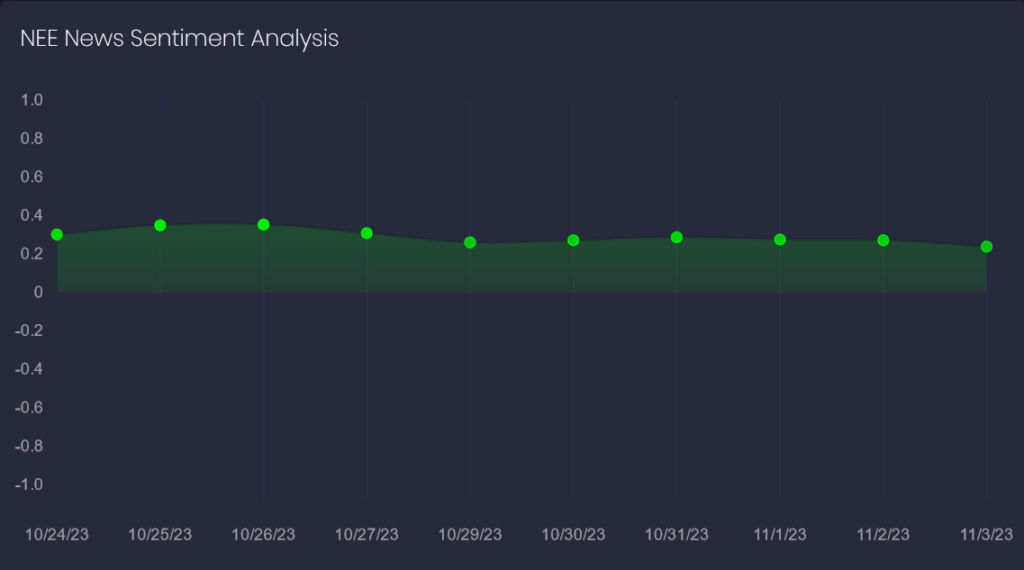

News Sentiment Data

The alternative data provided by FinBrain enriches the narrative further. The news sentiment score for NEE remained in positive territory, indicating a bullish outlook in media coverage. This sentiment is a vital indicator as it often precedes market movements, providing investors with a sentiment-based compass.

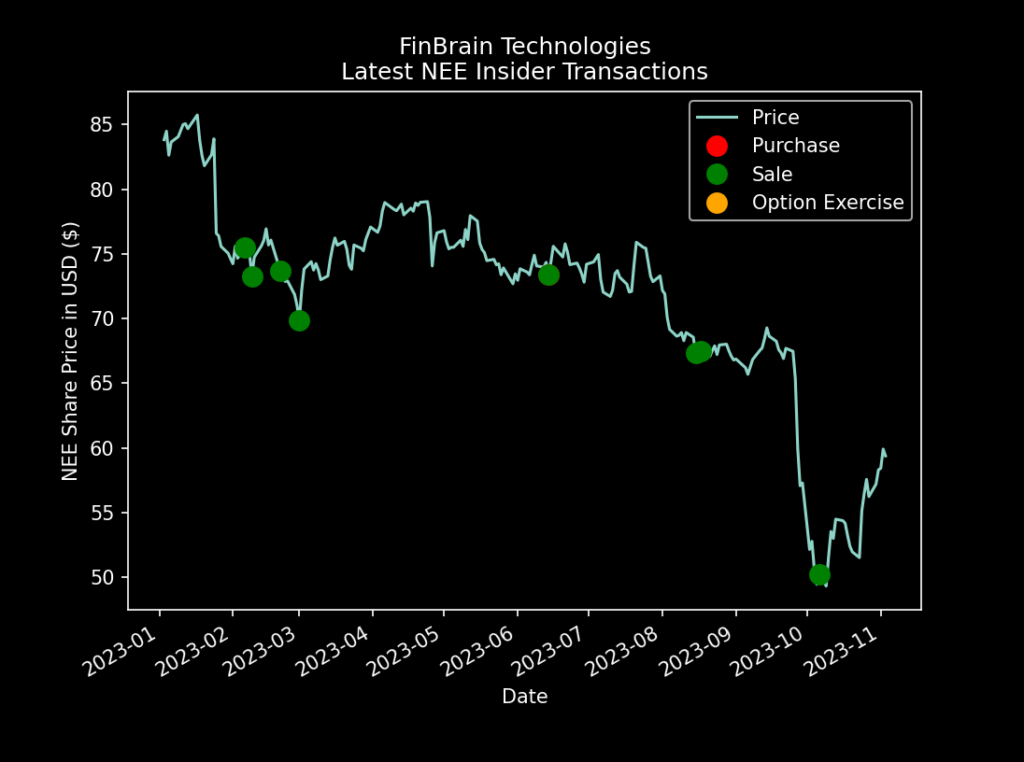

Latest Insider Transactions

Moreover, the latest insider transactions were predominantly buys from company executives and buybacks. Such activities are a strong vote of confidence from those at the helm, suggesting an insider perspective on the company’s promising future. This insider confidence is a critical piece of the puzzle for investors interpreting the NEE stock outlook.

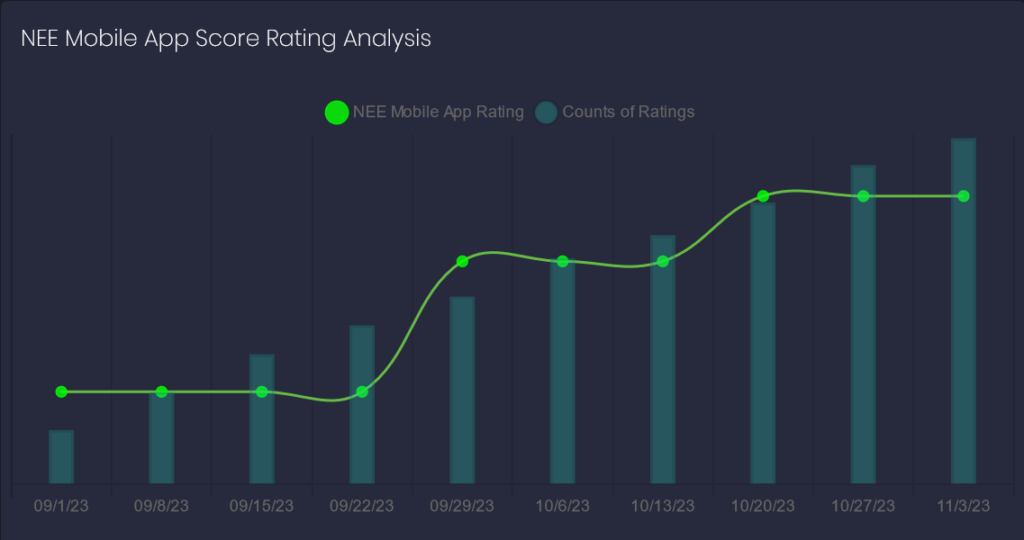

Mobile App Score Ratings

Another layer of alternative data comes from the mobile app scores for NextEra’s FPL app, which have seen an uptick in recent months. The app’s user rating of 4.14/5 is not just a measure of customer satisfaction but also serves as a proxy for the company’s service quality and, by extension, its market reputation.

These alternative data points, when combined with AI predictions, offer a comprehensive view of the stock’s potential trajectory. They serve as a testament to FinBrain’s ability to harness diverse data streams, from sentiment analysis to insider transactions, in forecasting stock movements.

FinBrain’s approach exemplifies the synergy between AI and alternative data, providing investors with a nuanced understanding of market dynamics. As we continue to refine our algorithms and expand our datasets, the goal remains to empower investors with actionable insights, helping them navigate the complexities of the stock market with greater confidence.

FinBrain Technologies: Pioneering AI-Driven Investment Strategies

FinBrain Technologies stands at the forefront of integrating AI with investment strategies, offering a suite of services that cater to savvy investors. Our AI-generated future price predictions are derived from deep neural network analyses of vast datasets, providing daily technical outlook reports and insights into company insider transactions. The inclusion of news & sentiment analysis data, US House & Senate trades, and options put-call ratios, among others, equips our clients with a comprehensive toolkit for informed decision-making.

With a global customer base spanning over 70 countries, FinBrain makes institutional-grade forecasting tools and alternative financial datasets accessible to individual investors. Our commitment to innovation is evident in the diverse markets we cover, including stocks, ETFs, futures, and currencies.

Conclusion and Invitation to Explore FinBrain

The case study of NextEra Energy’s stock forecast through AI algorithms and alternative datasets underscores the transformative impact of technology on investment strategies. FinBrain Technologies invites you to explore the potential of AI-assisted investing by visiting our main website and FinBrain Terminal. For institutional traders and data-driven funds, our FinBrain API offers unparalleled access to our extensive data resources.

Discover how FinBrain can enhance your investment returns and provide you with an informational edge. Join us at FinBrain and be part of the future of investing.

FinBrain Technologies

www.finbrain.tech

[email protected]

99 Wall St. #2023 New York, NY 10005

Twitter • LinkedIn • Instagram • Facebook