Stocks Don’t Always Go Up

You have probably heard the saying “stocks only go up” many times in the recent weeks. NASDAQ has lost 30% of its value between February 19 and March 23. As FED has decided on printing more money (digitally for sure) to save the markets, the stocks started to see a huge upside. NASDAQ has regained what it has given back, and seen all time highs again and again.

As the COVID-19 cases have seen a massive surge in the United States in parallel, the fears of a downturn escalated. Eventually the fears of a recession caused by COVID-19 have outweighed, and the markets turned red.

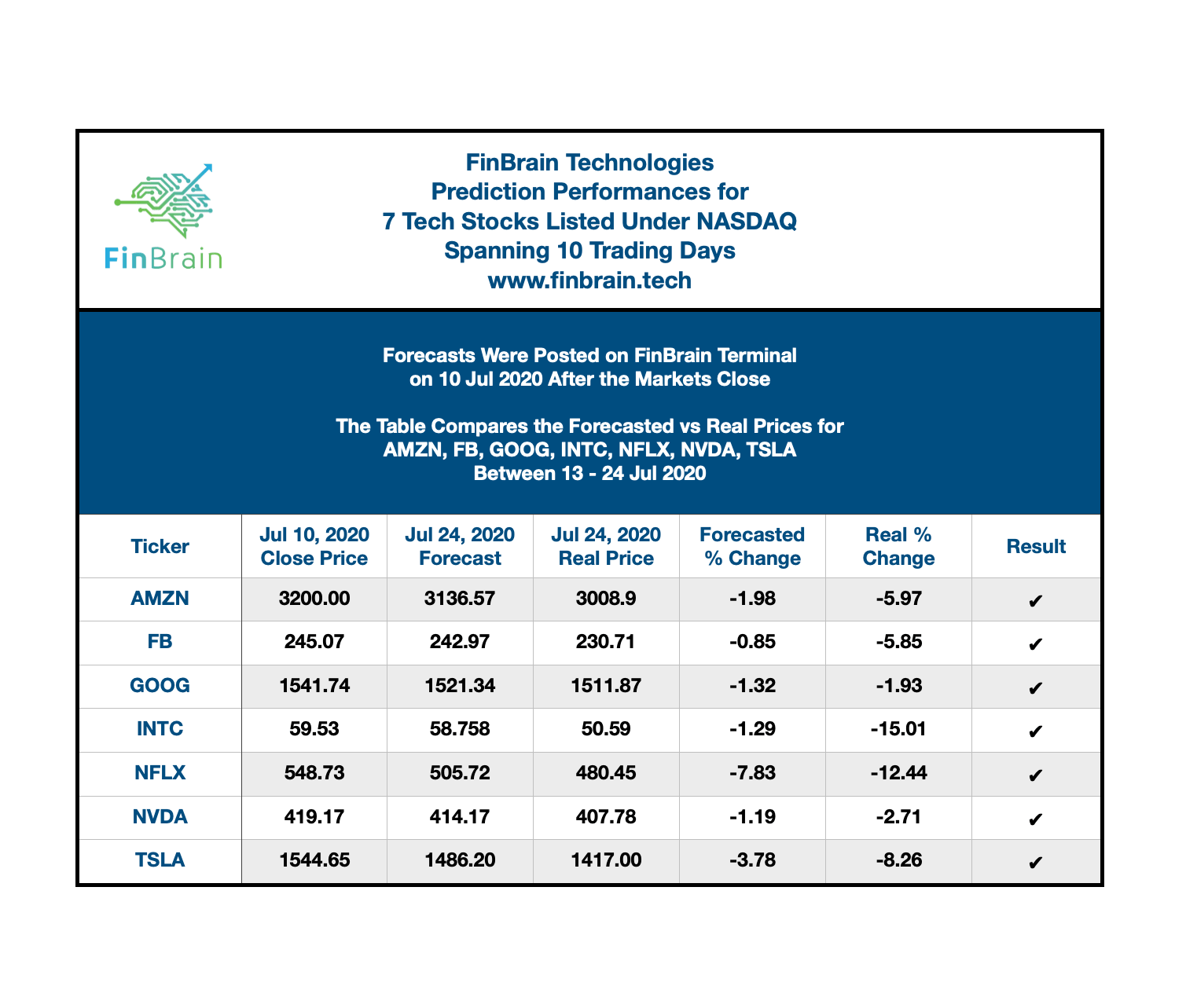

The stock prices were at the overextended side, and FinBrain’s algorithms have seen a strong downside potential on the tech stocks. Our models have indicated a potential downside in major tech stocks, which varied between 1-8% for AMZN, FB, GOOG, INTC, NFLX, NVDA and TSLA.

Deep Learning algorithms are exhibiting a great performance on spotting the downsides just as well as the upsides. In a recent article we have shared on our past performances blog, FinBrain has correctly predicted the massive gains scored by AAPL, AMZN, FB, GOOG and MSFT within a 10 day period. You can read the article on this link and see how we predicted the increase in Top 5 Tech Stocks listed under NASDAQ.

Expected vs. Real Prices for the 10 Trading Day Period: 13 – 24 Jul 2020

FinBrain’s 10-Day Ahead Prediction Performances for 7 Tech Stocks Listed Under NASDAQ

How did FinBrain spot the downside right on time?

We have posted the target prices, expected percentage change values and price movement directions for these stocks, after the markets closed on July 10, 2020 within FinBrain Terminal.

As clearly seen from the results above, the Deep Learning algorithms are able to spot the downsides just as good as the upsides. FinBrain helps the traders and investors in spotting the best opportunities in the market by analyzing massive amounts of financial data on their behalf.

AI Algorithms React Faster

The traditional fundamental and technical analysis methods fall short on capturing the rapid changes in the market behavior, whereas the AI algorithms collect massive amounts of data and react to the changes faster.

Our unmatched capability of collecting and analyzing stock prices, market movements, indicators and news for more than 11.000 financial assets, make it much easier for the traders to generate consistent profits.

FinBrain Technologies provides AI enabled daily and monthly predictions for US, Canada, UK, Australia, Germany, Hong Kong, Saudi Arabia stocks, commodities, foreign currencies and exchange traded funds on FinBrain Terminal.

Register now on our website https://finbrain.tech, start your unlimited free trial for 14 different markets and download our e-book on this link for free.

Best Regards,

FinBrain Technologies

99 Wall Street #2023

New York, NY 10005