Introduction

The world of stock market investing is being revolutionized by Artificial Intelligence (AI) and alternative data. In this blog post, we explore how AI algorithms and diverse datasets can predict stock market performance, focusing on a real-world case study of Adobe Systems Inc. (ADBE).

We’ll delve into ADBE’s company profile, recent news, and analyze AI-generated forecasts provided by FinBrain Technologies, a leader in AI-driven financial predictions.

Adobe Systems Inc. (ADBE) Overview

Adobe Systems Inc., founded in December 1982, operates in the technology sector, offering a range of software products and services widely known for their innovation and quality.

With approximately 29,000 employees and a market capitalization of $278.86 billion, Adobe stands as a technology behemoth. Despite not offering dividends, the company’s Year-To-Date (YTD) stock performance has been impressive, showing an upsurge of 81.78%. Its Price-to-Earnings (P/E) ratio stands at 55.14, reflecting investor confidence in its future growth prospects.

AI Predictions and Alternative Data Insights

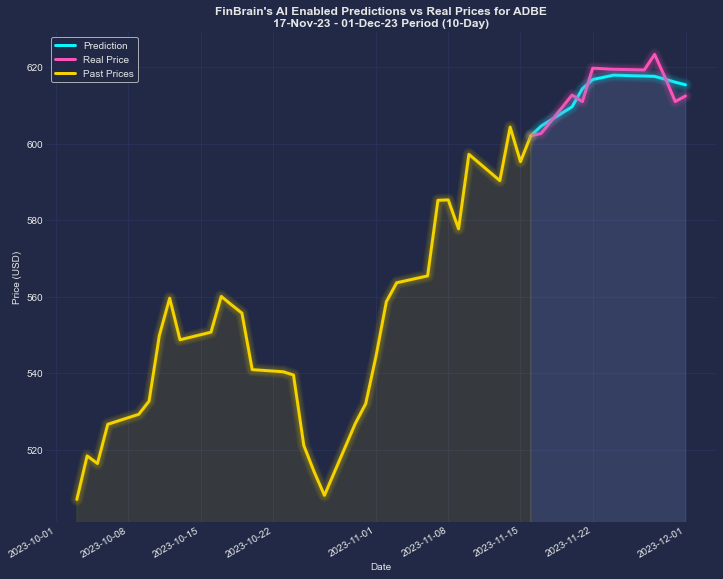

The predictive power of AI in the stock market is exemplified by FinBrain Technologies’ recent analysis of ADBE stock. Between November 17 and December 1, 2023, FinBrain’s AI algorithms provided 10-day ahead predictions for ADBE, showcasing a remarkable Normalized Mean Squared Error (NMSE) of 0.582. This indicates a high level of accuracy, as the real stock price movements closely mirrored these predictions.

FinBrain’s AI Stock Forecast Performance for ADBE

- Initial Prediction: On November 16, 2023, before market open, ADBE’s stock was priced at $602.06.

- Forecasted Price: FinBrain predicted a rise to $615.38, indicating a 2.21% increase.

- Actual Outcome: ADBE’s real closing price on the forecast’s end date was $612.47, translating to a 1.73% increase.

- Analysis: FinBrain’s predictions almost perfectly aligned with the actual price movement, as evident from their ADBE forecasts page.

Alternative Data on ADBE

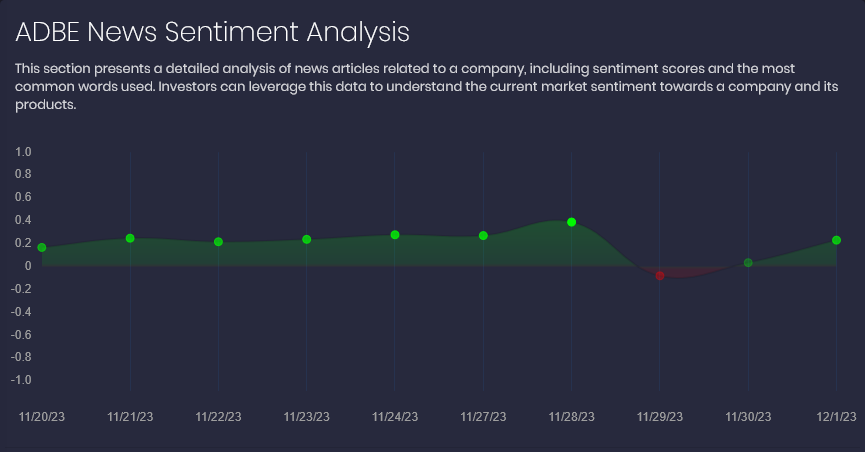

News Sentiment Data

During the forecast period, FinBrain’s news sentiment analysis for ADBE remained mostly positive. A notable exception was on November 29, where a negative sentiment coincided with a downward price movement.

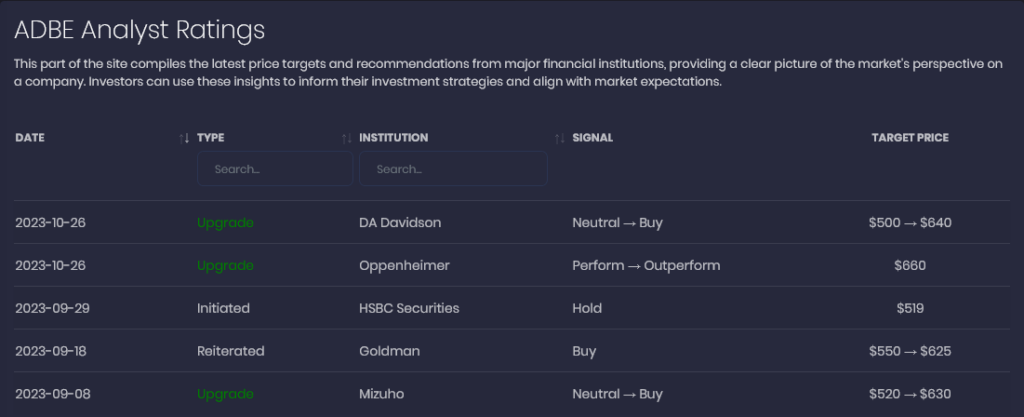

Analyst Ratings Data

In September and October, prominent analysts from DA Davidson, Oppenheimer, and Mizuho expressed a bullish outlook on Adobe Systems Inc. (ADBE) by significantly upgrading their price targets to $630 and above.

These upgrades, as published on the ADBE stock page on FinBrain Terminal, are a strong indicator of the growing confidence among major financial analysts in the stock’s potential.

Such upward revisions in price targets not only reflect an optimistic view of Adobe’s future performance but also suggest that the company is well-positioned to continue its growth trajectory in the tech sector.

This alignment of analyst expectations with positive AI forecasts further reinforces the bullish sentiment surrounding ADBE stock.

FinBrain Technologies: Revolutionizing Investment Strategies

FinBrain Technologies is at the forefront of AI-assisted and data-driven investing, offering services that include AI-generated future price predictions, daily technical outlook reports, news and sentiment analysis, and much more.

With customers in over 70 countries, FinBrain democratizes access to institutional-grade AI forecasting tools and alternative financial datasets for individual investors worldwide. Their comprehensive offerings cover a vast array of assets, including stocks, ETFs, futures, and foreign currencies. Learn more about FinBrain’s innovative services.

Services Provided by FinBrain

- AI-Generated Future Price Predictions: Utilizing deep neural networks to analyze massive datasets.

- Daily Technical Outlook Reports: Providing insights on company technical status, top holders, and analyst recommendations.

- News & Sentiment Analysis Data: AI/NLP algorithms analyze news from major financial sources.

- US House & Senate Trades: Insights into trades by US congress members.

- Company Insider Transactions: Tracking insider confidence in their companies.

- Options Put-Call Ratios and Mobile App Scores: For bullish/bearish signals and user satisfaction insights.

- Analyst Ratings: Latest price targets and analyses from major financial institutions.

- Mobile App Scores: Evaluating user satisfaction with a company’s apps as a performance indicator.

- LinkedIn Company Data: Analyzing publicly traded company data from LinkedIn for early growth signals.

Explore FinBrain Terminal and FinBrain API for detailed insights and predictive data.

Conclusion

FinBrain Technologies demonstrates how AI and alternative data can be powerful tools for investors. By analyzing companies like Adobe Systems Inc., they provide accurate forecasts and valuable insights, aiding investors in making informed decisions. To learn more and register for their services, visit FinBrain’s website.

Further Reading

For more successful examples of AI stock forecasts and the use of alternative datasets, check out these case studies:

- BAC Stock Forecast Performance

- NEE Stock Forecast Case Study

- Forecasting NKE Stock Price Using AI

- AI & Alternative Data Forecast for AFRM

- XOM Stock Forecast Performance

- IBM Overview and Stock Forecast

- Deep Dive in ARKW Price Forecast

FinBrain Technologies

www.finbrain.tech

[email protected]

99 Wall St. #2023 New York, NY 10005

Twitter • LinkedIn • Instagram • Facebook