Introduction

The stock market is an ever-evolving landscape, where investors constantly seek the edge that can lead to profitable investment decisions. In recent years, the integration of Artificial Intelligence (AI) and alternative datasets in stock market predictions has emerged as a game changer.

This blog post will specifically explore the predictive performance of AI algorithms using Alphabet Inc. (ticker: GOOG) as a real-world case study, demonstrating how these advanced tools can guide investors in making more informed decisions.

Alphabet Inc. – An Overview

Company Profile

Alphabet Inc., founded on October 2, 2015, stands as a technological behemoth in today’s digital era. Operating in various sectors, Alphabet is renowned for its wide range of products and services, most notably Google, its flagship subsidiary. With a massive employee count of approximately 182,000, Alphabet Inc. has cemented its position as a leader in innovation and technological advancement.

Financial Overview

As of the current financial year, Alphabet Inc. boasts a robust market capitalization of $1.91 trillion USD. The company’s stock performance has been noteworthy, with a year-to-date (YTD) increase of 10.20%. Despite not offering dividends, the company’s P/E ratio stands at an impressive 29.47, reflecting its strong market presence and investor confidence.

AI Predictions and Alternative Data Insights

AI-Driven Forecasting

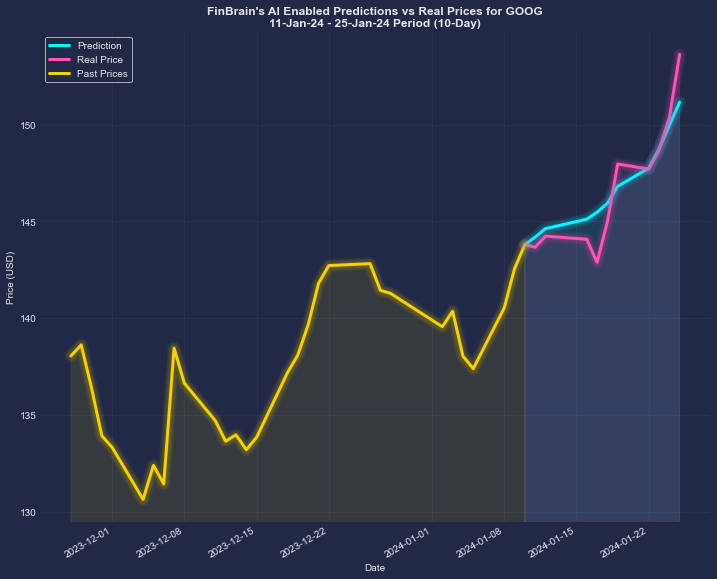

Recent forecasts by FinBrain for GOOG stock between January 11 and January 25, 2024, have showcased remarkable accuracy. With a Normalized Mean Squared Error (NMSE) of 0.337, these predictions almost perfectly mirrored the real stock price movements.

On January 10, 2024, the closing price of GOOG stock was $143.80, and FinBrain’s forecast anticipated a rise to $151.16, indicating a 5.12% increase. The actual closing price on the final day of this period was $153.64, a 6.84% rise, underscoring the precision of FinBrain’s AI algorithms.

The Role of Alternative Data

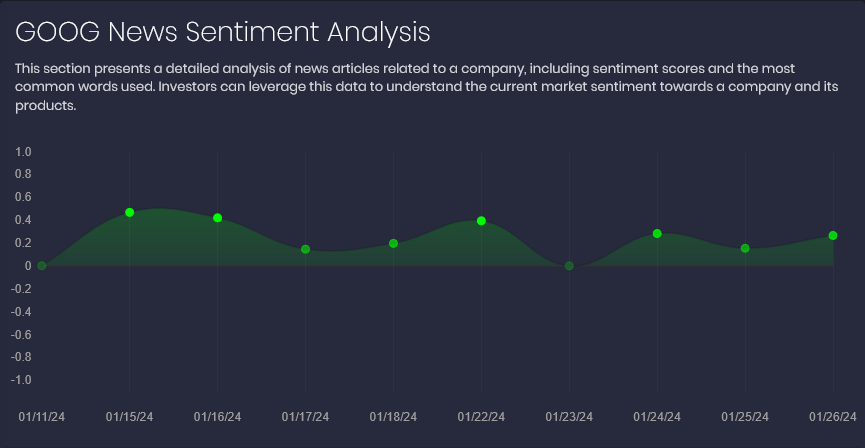

During this period, the news sentiment for GOOG was predominantly positive, a factor that likely contributed to the stock’s performance.

Moreover, the put-call ratio for GOOG was below 1, suggesting a prevailing bullish sentiment among traders. These insights, derived from alternative data, further affirm the accuracy of FinBrain’s predictions.

Using AI stock forecasts, news sentiment, and put-call ratio data in combination is vital for investors seeking a comprehensive understanding of stock market dynamics.

The convergence of these diverse data sources offers a richer, more nuanced understanding of market trends and investor sentiments, essential for navigating the complexities of the stock market.

FinBrain Technologies: Pioneering AI in Stock Market Forecasting

At FinBrain Technologies, we are committed to leveraging the power of AI and alternative data for stock market forecasting. Our services, accessible through the FinBrain Terminal, include AI-generated future price predictions, daily technical outlook reports, and comprehensive sentiment analysis data. We also offer insights into US House & Senate trades, company insider transactions, analyst ratings, options put-call ratios, and mobile app scores. Our services cater to individual investors and institutional traders alike, providing them with cutting-edge tools for data-driven investing.

Our Global Reach

FinBrain serves a diverse clientele from over 70 countries, offering daily forecasts for more than 10,000 assets across various markets. Our commitment to providing institutional-grade AI forecasting tools and unique financial datasets has made us a leader in the industry.

Empowering Investors with AI and Data

Our AI models analyze massive amounts of data to model future price movements, while our alternative datasets provide deeper insights into market sentiment and trends. This combination empowers investors to make more informed decisions, backed by the power of AI and data.

Case Studies About AI and Alternative Data in Stock Forecast

Our successful predictions, such as the Adobe (ADBE) stock forecast, Bank of America (BAC) stock performance, and NextEra Energy (NEE) stock forecast, exemplify the efficacy of our AI-driven approach. These case studies, among others, highlight the precision and reliability of our predictions.

Discover how FinBrain Technologies can enhance your investment strategy with AI-driven insights and alternative data. Visit us at FinBrain’s main website and explore the future of investing.

Unlock Your Investment Potential with FinBrain

FinBrain Technologies

www.finbrain.tech

[email protected]

99 Wall St. #2023 New York, NY 10005

Twitter • LinkedIn • Instagram • Facebook