Devon Energy Corporation is an energy company engaged in hydrocarbon exploration in the United States.

Despite the volatility in the underlying commodity prices, Devon Energy shares continue to gain investors’ confidence, based on robust dividend growth and buybacks.

The company’s shares are up 65% YTD and the annual dividend yield is at 6.19%.

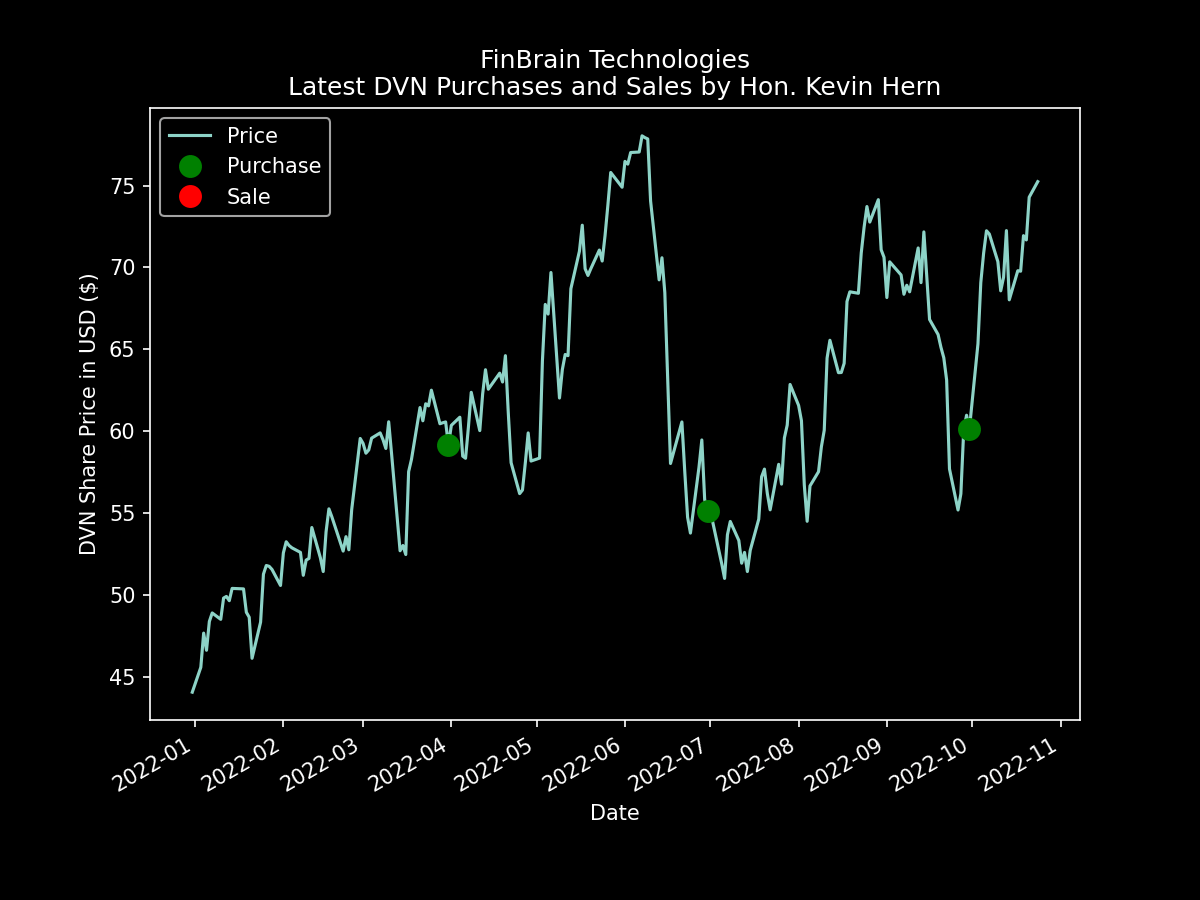

Recently, we have spotted an interesting purchase activity by US House Representative Kevin Hern. The US House members’ transactions data on DVN stock forecast page under FinBrain Terminal has revealed that a number of DVN stock purchases were made by Hon. Kevin Hern for the past couple of months.

Kevin Hern has made some significant purchases on Mar 31, Jun 30 and Sep 30. His cost basis is between $55-60 on average and the total amount of his recent purchases lies between $50k-180k. Please note that these figures do not include his purchases during the past year.

DVN has closed the trading day at $74.3 on Oct 24, 2022. Considering the fact that US Representative Kevin Hern’s cost basis is between $55-60 for DVN, we can conclude that his latest purchases are up almost 30%.

We have also plotted his purchases on DVN stock price chart, to visualize where the cost basis for his transactions are corresponding to.

The fact that Kevin Hern has an assignment on Committee on Natural Resources makes his trades for the energy stocks more interesting to track. The points where he bought the shares of DVN are also close to the dip points on the chart.

Moving from the results above, we can easily conclude that tracking the latest US Congress transactions published on FinBrain Terminal can give you a massive edge in the markets.

Another bullish indicator for Devon Energy taken from FinBrain Terminal is the positiveness of the news sentiment scores. The news sentiment for DVN was in the positive territory for the last 2 weeks, as all major news sources have been publishing bullish articles about their future expectations on DVN stock.

The facts that DVN paying high dividend yields and rebounding oil prices make the stock very attractive for the investment researchers as well.

The latest put-call ratio for DVN was at 0.26 – which is way below one – indicating that the traders are buying and selling the call options at volumes 3-4x more than the put options. The put-call ratio remained below 1 for the last 2 weeks, which is a strong signal of a bullish expectation by the traders.

The near term outlook for Devon Energy seems positive, as confirmed by 3 different types of Alternative Datasets on FinBrain Terminal. Latest US House Representatives’ trades, news sentiment scores and put-call ratio datasets are really important to track as they might send some strong bullish or bearish signals for the stocks listed under NASDAQ and NYSE markets.

There is no better time than now. Start your data-driven investing journey by leveraging the power of alternative datasets for the US stocks on FinBrain Terminal today.

FinBrain Technologies

99 Wall St. Suite #2023, New York, NY 10005