FinBrain’s State of the Art Deep Learning Algorithms

FinBrain Technologies develops and applies advanced time series data processing, convex optimization techniques, deep neural network models and portfolio optimization algorithms to financial datasets. Thanks to FinBrain Team’s background in Engineering, Mathematics, Statistics and Signal Processing, a set of different methodologies have been merged together to obtain the best prediction accuracy for Stocks, World Indices, Commodities, Foreign Currencies and ETFs.

FinBrain’s algorithms collect gigabytes of financial data, from different sources for more than 6000 assets on a daily basis. Our algorithms that are specifically built for data collection purposes, look at various data sources obtain and organize large datasets into a machine-understandable format. A number of time series and signal characterization techniques are being applied to those datasets in order to prepare the data for the Deep Neural Network calculations. FinBrain’s state of the art Deep Neural Network models are optimized for the best performance on the future predictions (unseen data) using different techniques that our CEO has mentioned on his speech at the AI in Finance Summit, NY. After the algorithms output the future predictions for thousands of assets, the results become available for our subscribers on our website.

FinBrain’s S&P500 Prediction Package

The S&P500 Prediction Package available on our website consist of the financial information and future predictions for approximately 500 stocks listed under the S&P500 index. The predictions are made available hours after the markets close, and our customers enjoy the advantage of having the information about where the stocks will be heading to, before the markets open the next day. The 10-day ahead predictions, together with the target price point for each day, are provided on the charts and tables. We also provide 3-day, 5-day and 10-day trade signals based on our predictions and model the future price movements. In order to keep the traders’ user experience at its highest and enabling a better understanding, we model the future price movement directions on the charts together with the historical prices. This is one of the main features where the FinBrain’s customers have an edge over the rest of the people trading out there in the market. Our customers can understand and visualize the dynamics behind the market movements thanks to our cutting edge algorithms.

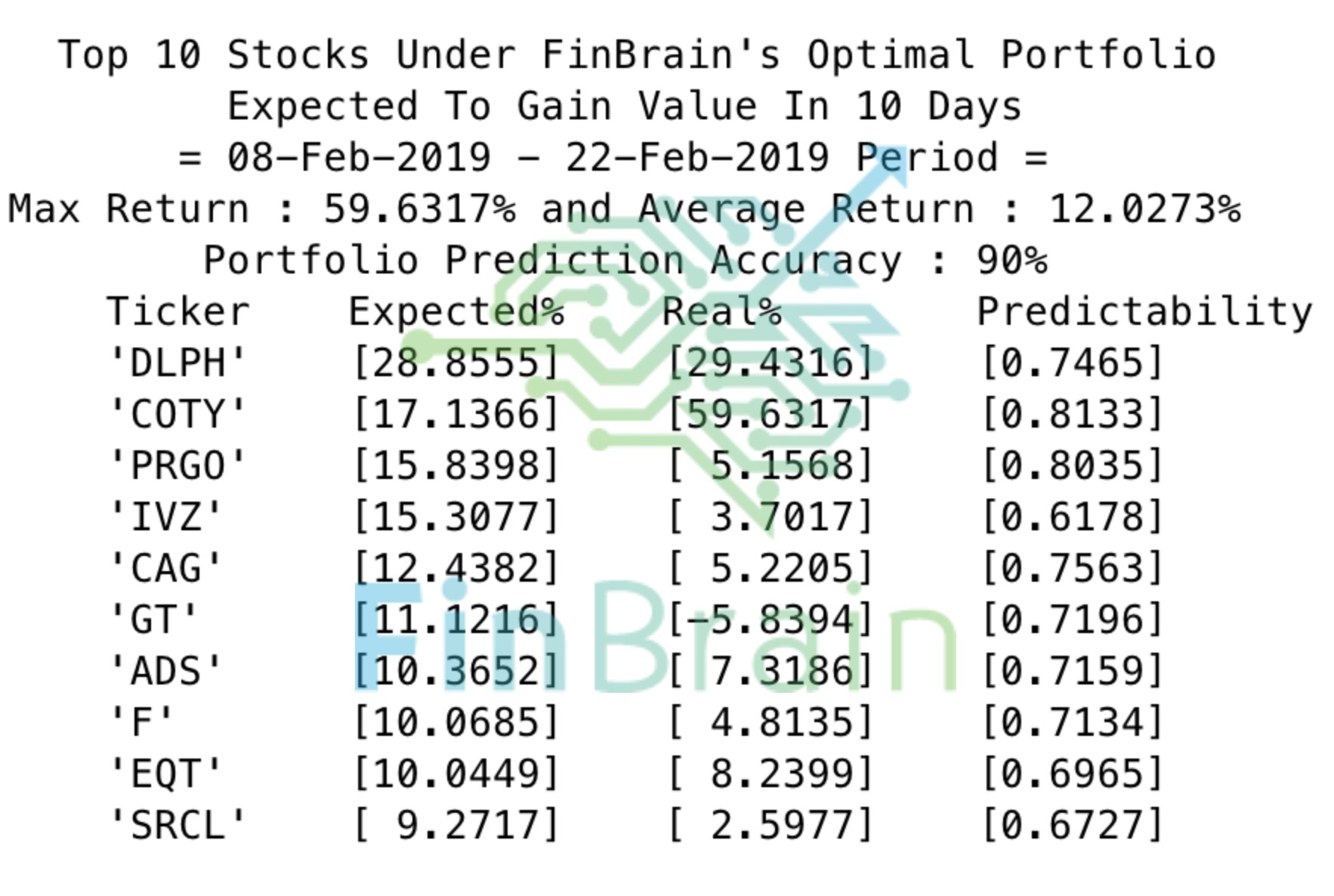

S&P500 Optimal Portfolio Performance – 08-Feb – 22-Feb

The optimal portfolio determined by FinBrain Technologies, consisting of Top 10 Stocks that were expected to gain value between 08-Feb-2019 – 22-Feb-2019 Period are given below. The maximum return yielded by a single stock given under the suggested portfolio was 59.63%. FinBrain has successfully predicted that the Coty Inc. (NYSE:COTY) would make a huge comeback. We were highly confident that the COTY stock would surge with a high percentage return, where our predictability value for the stock was 0.8133 (the highest confidence among the stocks in our portfolio and the rest of the stocks listed under the S&P500 market). We have correctly predicted 9 out of 10 stocks given under our optimal portfolio that yielded an average return of 12.02% in just 10 trading days, where the S&P500 index has returned 3.2%.

We strongly recommend you to start utilizing our Deep Learning enabled prediction technologies to maximize your investment returns and minimize risks. Our algorithms analyze vast amounts of information at the speeds that no human being can perform, and then choose the best possible portfolio combination to beat the market significantly.

FinBrain Technologies, 2019