Markets present you with great opportunities

Every month, we keep publishing how our algorithms performed for the stocks listed under US Stock Markets.

The stocks keep moving, and obviously there is so much opportunity out there to generate decent profits.

But, how will you spot the biggest movers days or months before they gain momentum?

How will you consistently spot the best opportunities and grow your account day over day, or month over month?

You need adaptive models, not the old-school static ones

You should already be aware that the fundamentals and technicals based investment methods are not generating considerable returns anymore.

What you need is a tool that monitor the markets, collect the data(pricing information, news) and analyze how the prices are affected, faster and better than anyone else. That’s the only way to beat the markets and move the money from the others’s pockets, into your pockets.

Why are the traders getting beaten in the markets?

The traders getting stuck with fundamentals, technicals and indicators are bound to lose money over the long run. The markets are changing, and you need adaptive tools to react to the changes in the market dynamics. Otherwise, you’ll get beaten by the others who have the AI and data analysis tools at their disposal and who utilize these tools in their investments.

You should be faster than the others to collect and analyze the information, because information is what’s driving the market movements.

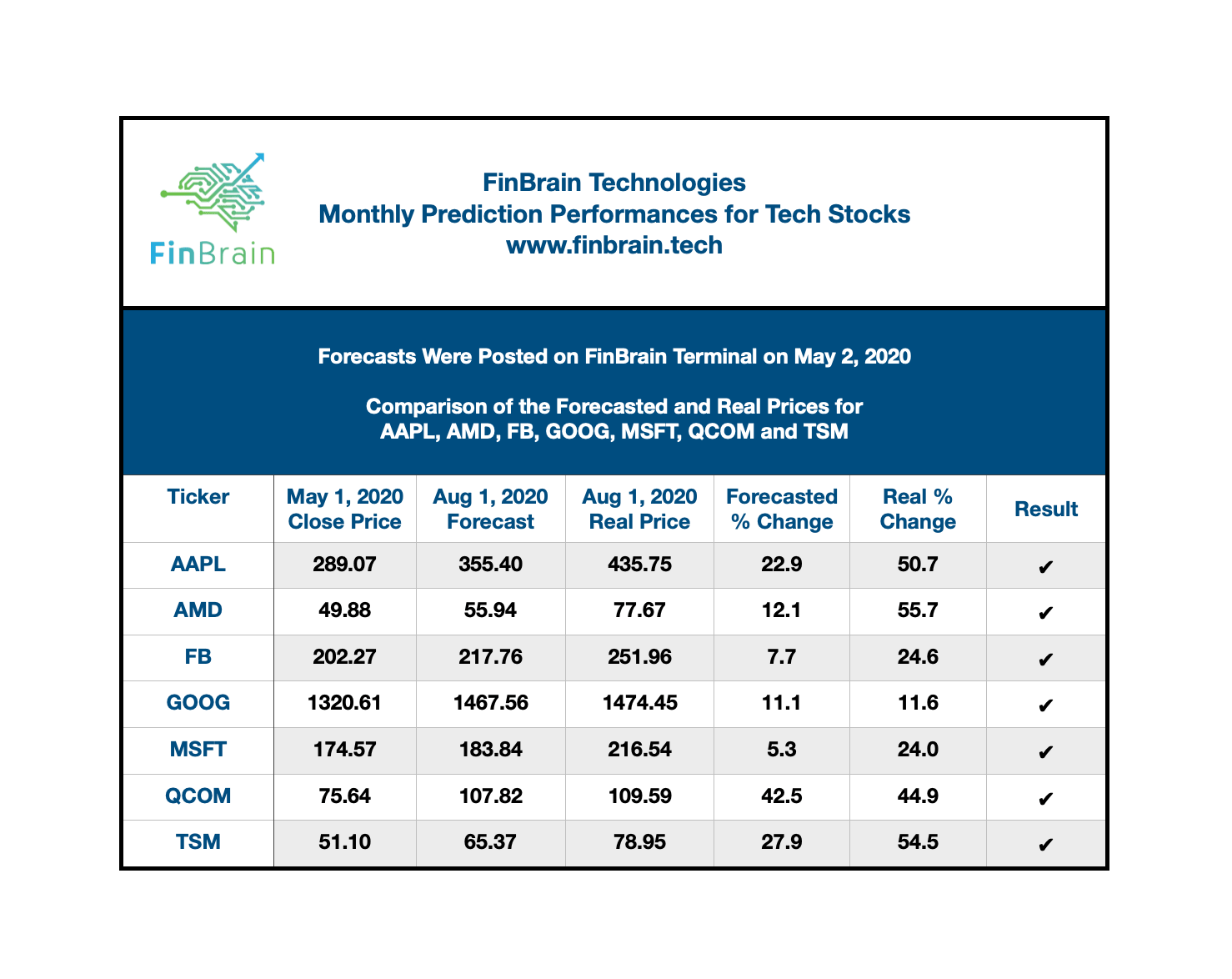

Here is how our algorithms performed for the largest cap tech stocks and a few semiconductor stocks within a 3 month period. Please note that these are not backtest results, but a comparison of the published predictions vs the real price values.

What about more than 50% returns in just 3 months?

AAPL, AMD and TSM stocks have yielded more than 50% returns in just 3 months. QCOM – Qualcomm Inc. has followed these stocks with a 44.9% return where FinBrain has predicted the stock to gain 42.5% in value at the beginning of May, 2020. FB, GOOG and MSFT stocks are also among the largest cap tech stocks listed under NASDAQ and they have also enjoyed decent gains. FinBrain’s AI enabled prediction models captured these movements with a close proximity, thanks to the self-learning and self-adapting algorithm structure.

As clearly seen from the results above, the markets present great opportunities for the ones who are ready to take it. Deep Learning Algorithms give a massive edge to the investors who choose to invest for both daily and monthly time periods.

FinBrain helps the traders and investors in spotting the best opportunities in the market by analyzing massive amounts of financial data on their behalf.

Our unmatched capability of collecting and analyzing stock prices, market movements, indicators and news for more than 11.000 financial assets make it much easier for the traders to generate consistent profits.

Register now on our website https://finbrain.tech, start your unlimited free trial for 14 different markets and download our e-book One Algorithm to Predict Them All for free.

Best Regards,

FinBrain Technologies

99 Wall Street #2023

New York, NY 10005

One response to “More Than 50% Returns in Just 3 Months? Have a Look at FinBrain’s Monthly Tech and Semiconductor Stock Prediction Results”

Hi,

I am a high tech executive. I came your website and find it very intriguing, but am lost in the information overload… Can you help me with recommendation of an trading approach for my grandkids?

I have a reasonably good background in technical analysis, use Advanced Get Elliott Wave software supported by Motley Fool’s recommendations and BarChart tools, but failed to create consistent returns.

I have 4 grandkids (13, 13, 14, 15). We are gifting them $10k each, their parents may match it, for college fund. We are opening for them custodian accounts at Schwab, which don’t allow trading calls and puts..

I am still working and can’t trade intraday. I could ideally place trades in the afternoon or evening.

What could you recommend for me to explore from your tools to enable a high growth of kids accounts? Where could I find historical returns for recommended strategy?

Thank you for your help.

Janusz