Markets Are Moving Fast and The Tech Sector is Leading The Rally

The markets are moving fast and the stocks are rallying despite the downside expected by some of the investors. Tech stocks are drive the rally in the stock markets, which carries NASDAQ composite to record all time high values.

Investors seem to be not worried about the rising COVID-19 cases. Tech stocks constitute more than the half of NASDAQ composite index. As people stay indoors, they tend to use internet based services and apps more and more. Work-from-home necessity has also increased the demand for computers and software products in general. Therefore, the investors have flocked to the tech companies that indicate the signs of stability, increasing profits and solid growth.

Paradigm Shift in Investing: Fundamentals Based Investing Is Losing Its Edge

Nowadays, the investing sector is also experiencing a paradigm shift as the new rules are defined for the stock markets and the market dynamics are changing rapidly. The old-school and widely popular investing techniques are becoming obsolete. Take Berkshire Hathaway for example, which is a company shaping their portfolios based on fundamental analysis techniques. Berkshire’s returns have been lagging behind the S&P500’s returns for the last 19 years. Also, BRK-A and BRK-B’s performances since the beginning of 2020 aren’t promising at all. This is a clear indicator that the fundamentals based investing is losing its edge rapidly.

Machine Learning Enabled Investing

Renaissance Technologies’ Medallion Fund however, is considered to be one of the most successful hedge funds ever. Jim Simons’ hedge fund is utilizing advanced mathematical models and machine learning techniques to analyze stocks and to establish profitable portfolios. This quantitative hedge fund’s flagship Medallion Fund has returned 66% on average and 39% after fees, since 1998. Thanks to the Machine Learning and Natural Language Processing technologies, Renaissance has beaten the markets significantly over a long period of time.

In an investment world where fundamentals and technicals based stock picking does not work anymore, investors are shifting to the new computer based systems that use Machine Learning and Deep Learning technologies in some form. FinBrain Technologies has created a state-of-the-art stock predictor system based on financial data analysis using deep learning techniques. Our models help swing traders and long term stock investors in yielding consistent and decent profits in the stock, commodity, foreign exchange and exchange traded fund markets.

FinBrain publishes the analysis and prediction results for more than 11.000 assets listed under 14 markets on a daily basis. We also provide 12-month ahead prediction results for long term investors who utilize buy and hold strategies.

Which results did our monthly predictions for AAPL, FB, GOOG, NFLX and NVDA yield?

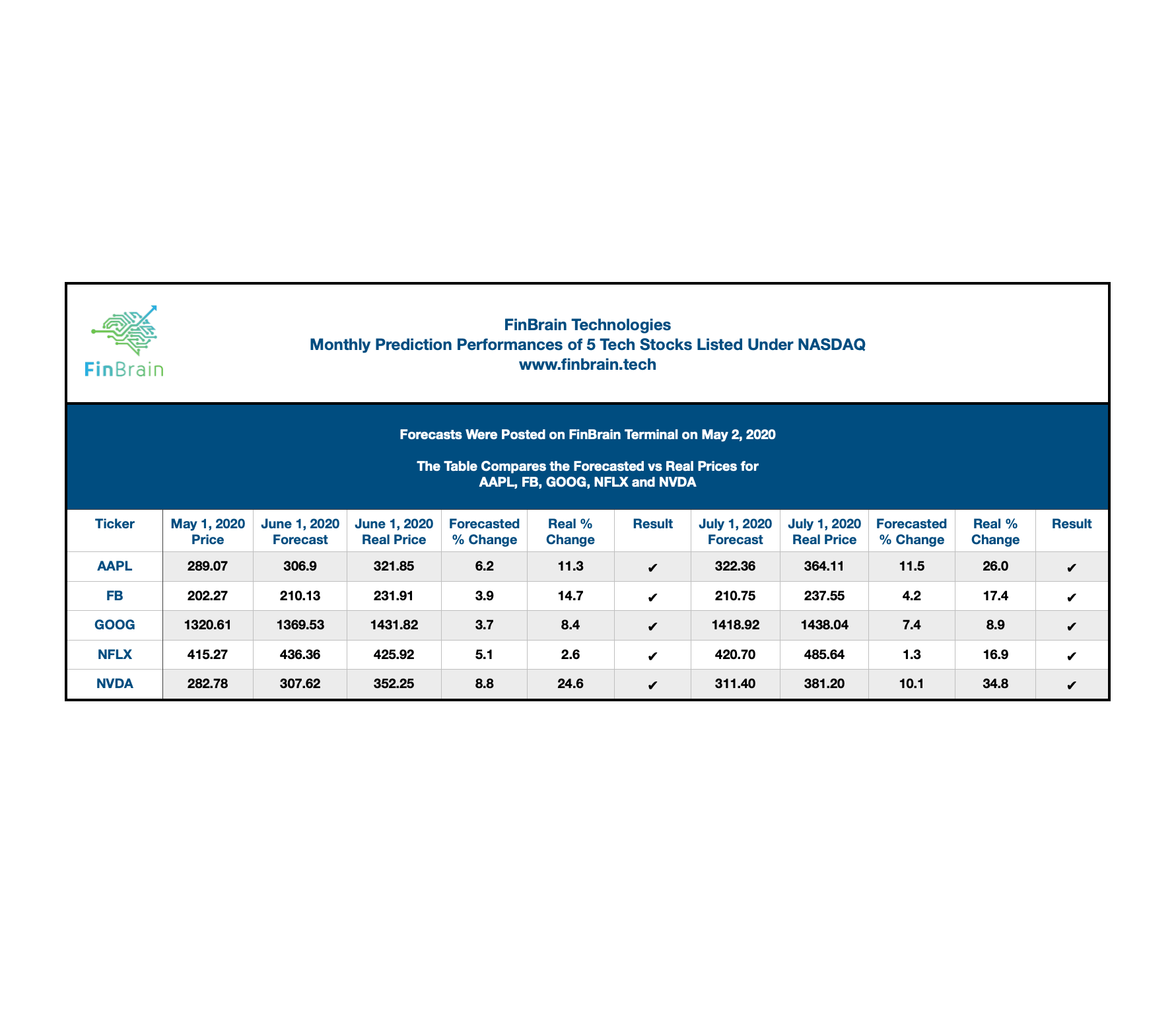

We would like to demonstrate how our months ahead predictions have worked for 5 large scale NASDAQ companies AAPL, FB, GOOG, NFLX and NVDA. These predictions were generated in May 2020 and were posted on FinBrain Terminal for the use of our customers from more than 60 countries all around the world.

AAPL – Apple Inc.

AAPL – Apple Inc.’s stock price was at $289.07 on May 1, 2020. FinBrain has projected the stock price to hit $306.9 in June 2020 and $322.36 in July 2020. Our algorithms have seen a strong upside for the AAPL stock for the short term with a 6% expected upwards move within one month and a 10% expected upwards move within two months. The stock price has seen $321.85 on June 1, 2020 and $364.11 in July 1, 2020. Our algorithms have correctly predicted the price movement direction and the target price points were hit successfully.

FB – Facebook Inc.

FB – Facebook Inc.’s stock price was at $202.27 on May 1, 2020. FinBrain has projected the stock price to hit $210.13 in June 2020 and $210.75 in July 2020. Our algorithms have seen an upside potential for the FB stock for the short term with a 4.2% expected upwards move within two months. The stock price has seen $231.91 on June 1, 2020 and $237.55 in July 1, 2020. FinBrain’s Deep Learning enabled stock analysis software has once again predicted the upward move by Facebook Inc. correctly.

GOOG – Alphabet Inc. Class C

GOOG – Alphabet Inc. Class C stock price was at $1320.61 on May 1, 2020. FinBrain has projected the stock price to hit $1369.53 in June 2020 and $1418.92 in July 2020. Our algorithms have projected the GOOG stock price to gain 3.7% value within one month and to gain 7.4% within two months. The stock price has seen $1431.82 on June 1, 2020 and $1438.04 in July 1, 2020 which correspond to a 8.9% increase in the stock’s value within two months. FinBrain has very closely predicted the price point where GOOG stock will be at, 2 months beforehand.

NFLX – Netflix Inc.

NFLX – Netflix Inc. stock price was at $415.27 on May 1, 2020. FinBrain has projected the stock price to hit $436.36 in June 2020 and $420.70 in July 2020. Our algorithms have projected the NFLX stock price to gain 5% value within one month and 1.3% within two months. The stock price has seen $425.92 on June 1, 2020 and $485.64 in July 1, 2020 which correspond to a 16.9% increase in the stock’s value within two months. Our algorithms have correctly predicted the price movement direction of another large scale NASDAQ component.

NVDA – NVIDIA Corp.

NVDA – NVIDIA Corp. stock price was at $282.78 on May 1, 2020. FinBrain has projected the stock price to hit $307.62 in June 2020 and $311.40 in July 2020. Our algorithms have projected the NVDA stock price to gain 8.7% value within one month and 10.1% within two months. The stock price has seen $352.25 on June 1, 2020 and $381.20 in July 1, 2020 which correspond to a massive 34.8% increase in NVDA stock’s value within two months. FinBrain’s stock forecasting algorithms have expected a strong upside potential on NVDA stock, where NVDA has even beaten our projections by gaining almost 35% in value.

As clearly seen from the results above, the Deep Learning algorithms also give a massive edge to the investors who choose to invest for longer time periods. FinBrain helps the traders and investors in spotting the best opportunities in the market by analyzing massive amounts of financial data on their behalf. Our unmatched capability of collecting and analyzing stock prices, market movements, indicators and news for more than 11.000 financial assets make it much easier for the traders to generate consistent profits.

Register now on our website https://finbrain.tech, start your unlimited free trial for 14 different markets and download our e-book “One Algorithm to Predict Them All” for free.

Best Regards,

FinBrain Technologies

99 Wall Street #2023

New York, NY 10005