Introduction

Investing in today’s fast-paced financial markets requires more than just traditional analysis. With the advent of AI-driven stock forecasts and alternative datasets, traders and investors can gain unprecedented insights into the factors driving stock prices.

Today, we’ll explore how FinBrain Terminal demonstrated its predictive prowess on AbbVie Inc. (ABBV) and why AI and data-driven investing should be part of your strategy.

AbbVie Inc. – A Pharmaceutical Giant

AbbVie Inc. is a global biopharmaceutical company founded in 2013 as a spin-off from Abbott Laboratories. Specializing in innovative medicines and therapies, AbbVie operates in the healthcare and pharmaceuticals sector, focusing on areas such as immunology, oncology, neuroscience, and virology.

With a market capitalization of $323.26 billion and a robust workforce of approximately 50,000 employees, AbbVie has cemented itself as a leader in its field.

In 2024, AbbVie’s stock (NYSE: ABBV) demonstrated a strong performance, gaining 14.46% year-to-date. The company also offers an attractive dividend of $1.64 per quarter, yielding 3.59% annually, making it a favorite among income-focused investors.

Despite a relatively high P/E ratio of 63.82, AbbVie’s focus on groundbreaking therapies keeps investor interest high.

Recent Developments in AbbVie

Recent news highlights AbbVie’s strides in expanding its product portfolio and addressing critical healthcare challenges. For instance:

Regulatory Approvals: AbbVie secured approvals for its next-generation immunology treatments, signaling a promising future in combating autoimmune diseases.

Pipeline Advancements: The company’s robust research pipeline has seen significant breakthroughs in oncology and rare diseases.

These developments strengthen AbbVie’s market position and may positively influence its stock price. Regulatory approvals often catalyze investor confidence, while advancements in the pipeline ensure sustainable growth.

Predictive Performance: A Real-World Case Study

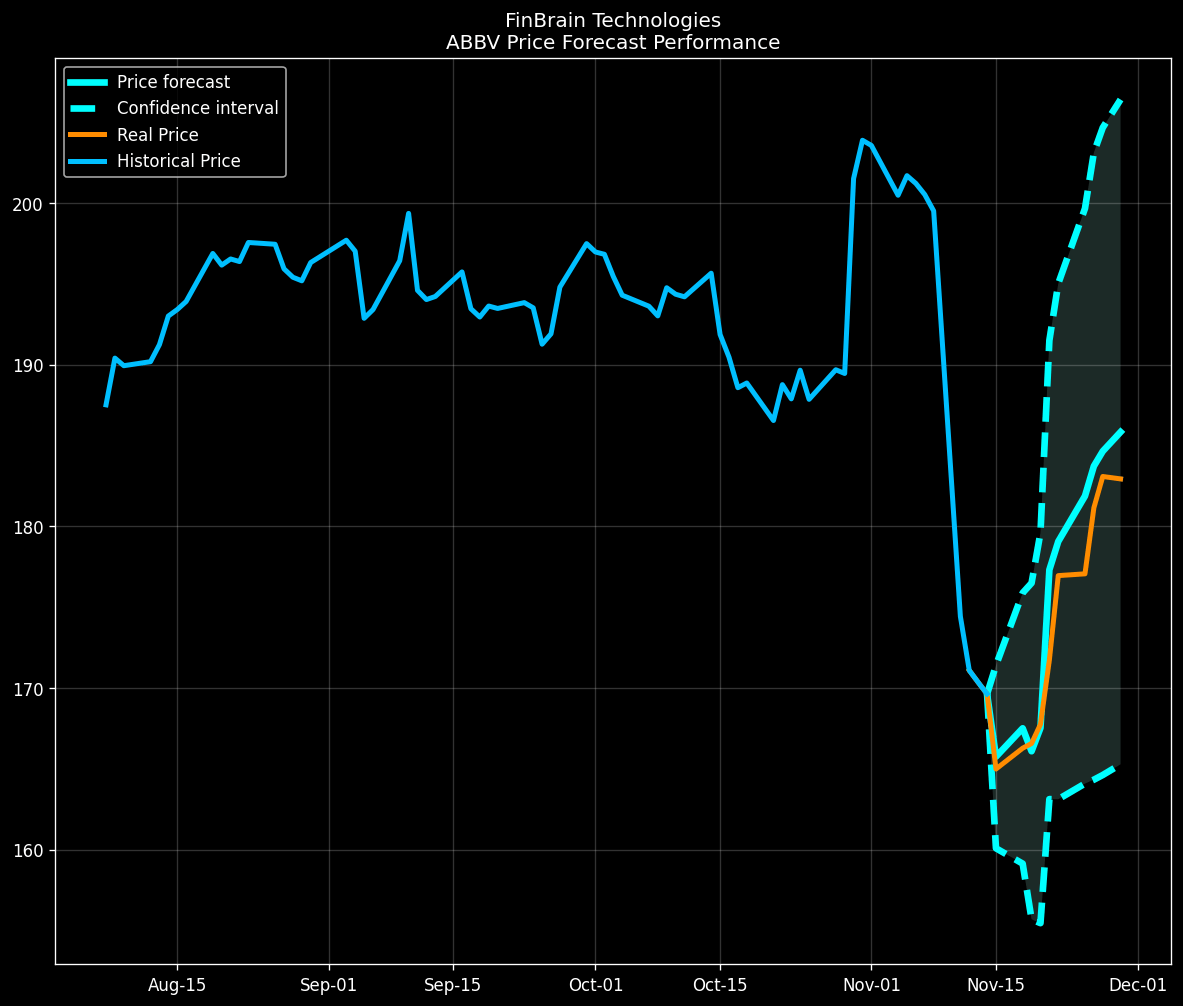

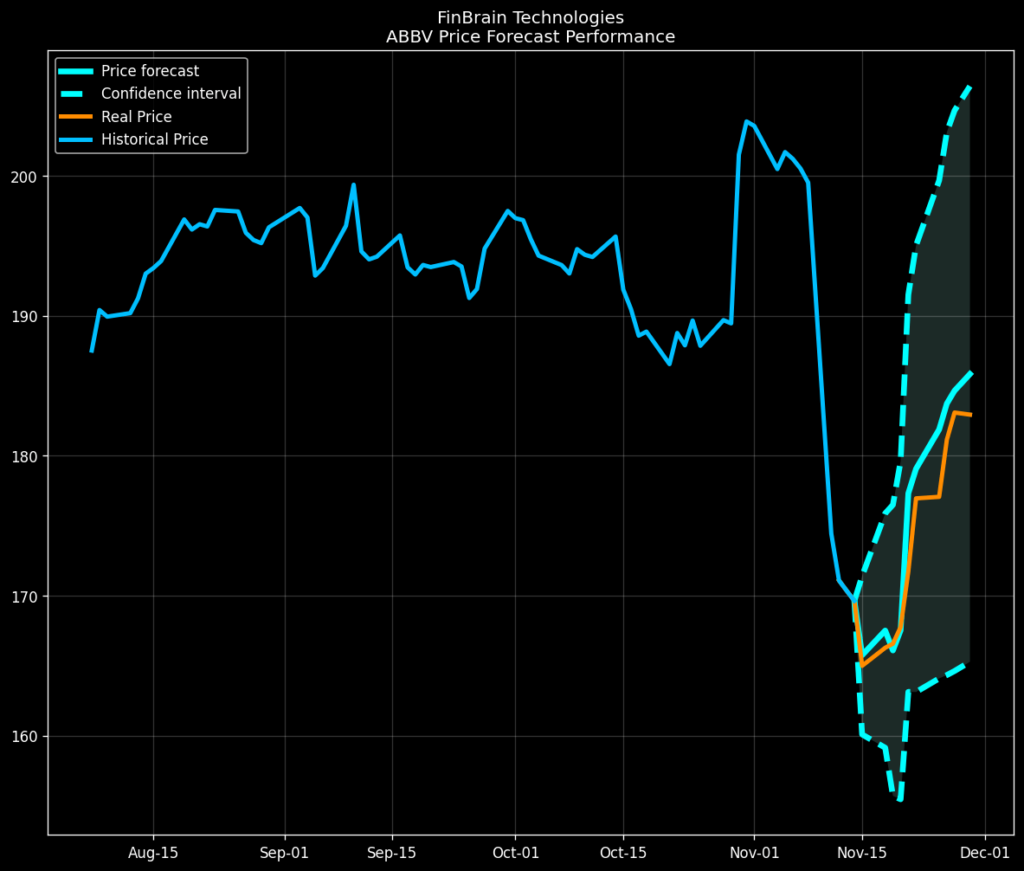

On 2024-11-15, FinBrain Terminal published its ABBV stock forecast, predicting a price of $185.83 by 2024-11-29. At the time, ABBV’s last closing price stood at $169.63. FinBrain’s AI forecasted a 9.55% increase, while the real price movement was 7.84% with ABBV closing at $182.93.

The price followed FinBrain’s predictions closely, staying well within the 95% confidence interval, showcasing the accuracy and reliability of its AI algorithms.

Traders who acted on these forecasts would have capitalized on the nearly perfect alignment between the predicted and actual stock movement.

Alternative datasets signaling the price movements beforehand

FinBrain Terminal also provides powerful alternative datasets to complement AI predictions.

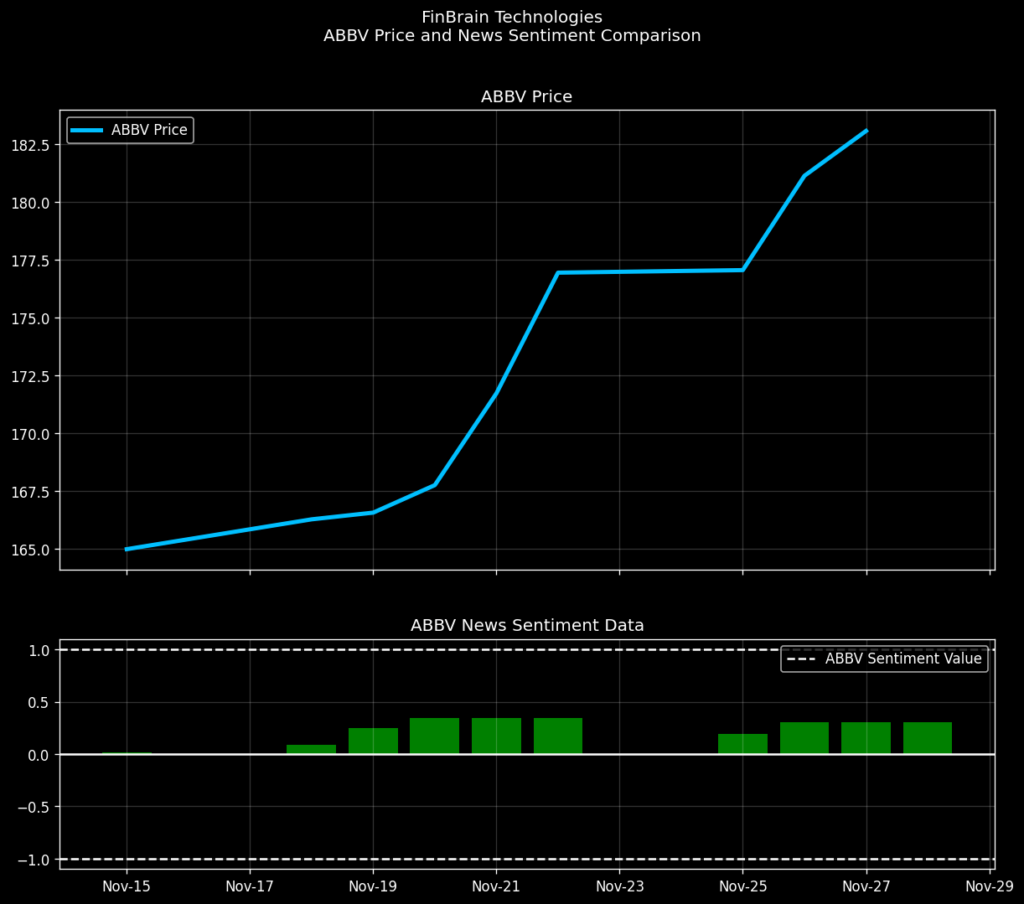

News Sentiment: During the prediction period, ABBV’s news sentiment was overwhelmingly positive. This sentiment often correlates with bullish price movements, offering traders actionable insights.

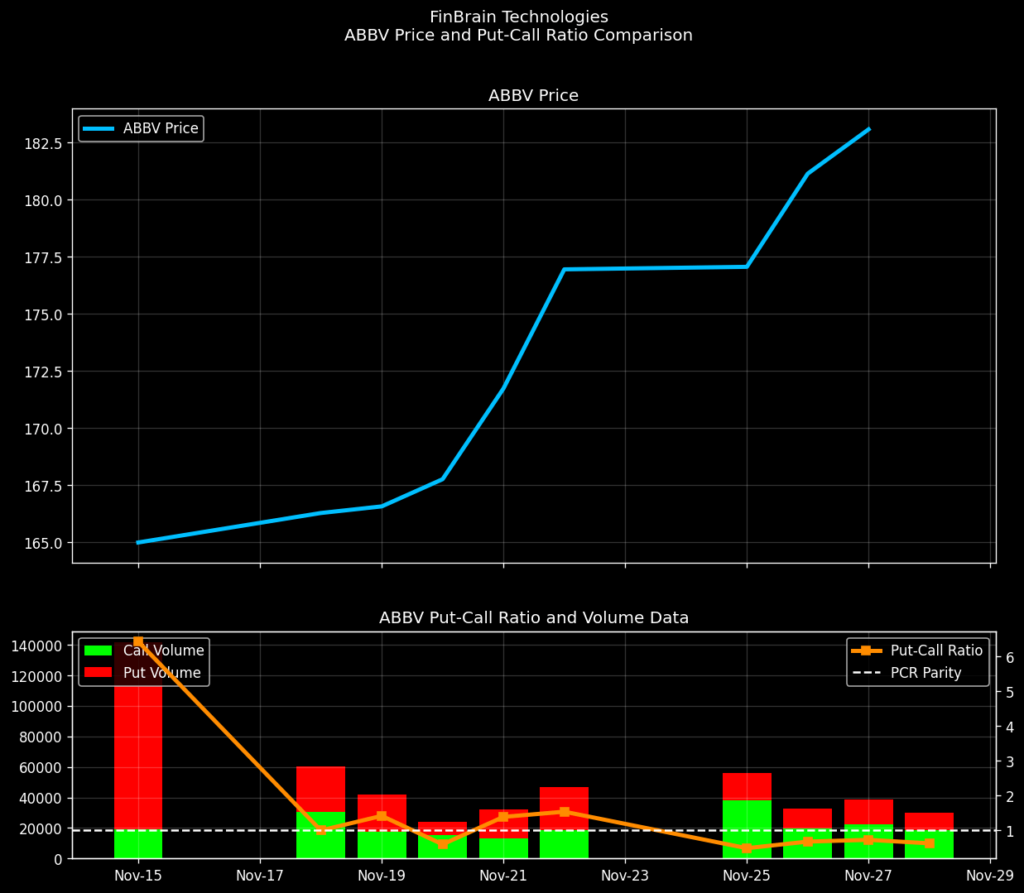

Put-Call Ratio: The put-call ratio exceeded 1 before the forecast period, signaling bearishness and a significant price drop. As the ratio declined below 1, it coincided with ABBV’s upward price trend, providing an additional layer of validation for FinBrain’s predictions.

Why You Need FinBrain Terminal

AI and data-driven investing are no longer optional; they are essential for success in today’s markets. FinBrain Terminal offers unparalleled datasets like mobile app scores, LinkedIn follower growth, and US Congressional trades—unique tools you won’t find elsewhere.

With FinBrain, you gain a competitive edge by accessing insider transactions and predictive models that indicate stock movement directions before they happen.

It’s time to stop relying on guesswork. Take advantage of FinBrain’s comprehensive insights and ensure you stay ahead of the curve.

FinBrain Technologies — Terminal & API for global coverage and alternative data

Talk to us: [email protected] • www.finbrain.tech