Introduction

In this article, we will explore how AI-driven forecasts and alternative data can be applied to real-world cases, using Gilead Sciences (GILD) as an example.

We will demonstrate how FinBrain’s predictions and datasets can provide actionable insights, helping traders stay ahead in the market.

About Gilead Sciences

Founded in 1987, Gilead Sciences is a leading biopharmaceutical company specializing in innovative medicines.

With a workforce of over 18,000 employees, Gilead focuses on developing life-saving therapies for HIV, liver diseases, and cancer. The company is renowned for its antiviral treatments, particularly in HIV and Hepatitis C, playing a pivotal role in transforming patients’ lives.

As of today, Gilead boasts a market capitalization of $105.76 billion. Its year-to-date stock performance shows a positive uptick of 4.86%, reflecting investor confidence.

With a P/E ratio of 103.60, Gilead’s valuation suggests high expectations from the market. The company also rewards shareholders with a dividend of $0.77 per share, yielding 3.63% annually, making it an attractive option for dividend-focused investors.

To learn more about the stock’s current movements and forecasted trends, check out the GILD stock forecast provided by FinBrain Terminal.

Latest News on Gilead Sciences

Gilead Sciences has recently made headlines with several advancements that could impact its stock performance. According to recent reports, Gilead is actively expanding its oncology pipeline, collaborating with smaller biotech firms to bring innovative cancer treatments to the market. Additionally, the company’s HIV and Hepatitis C franchises continue to perform well, with promising clinical trials for next-generation antiviral drugs.

These developments may bolster Gilead’s stock price by attracting investor attention and driving demand for its shares. As the company further strengthens its product pipeline and enhances its market position, we could see a positive impact on GILD’s performance.

FinBrain’s Predictive Performance for GILD Stock

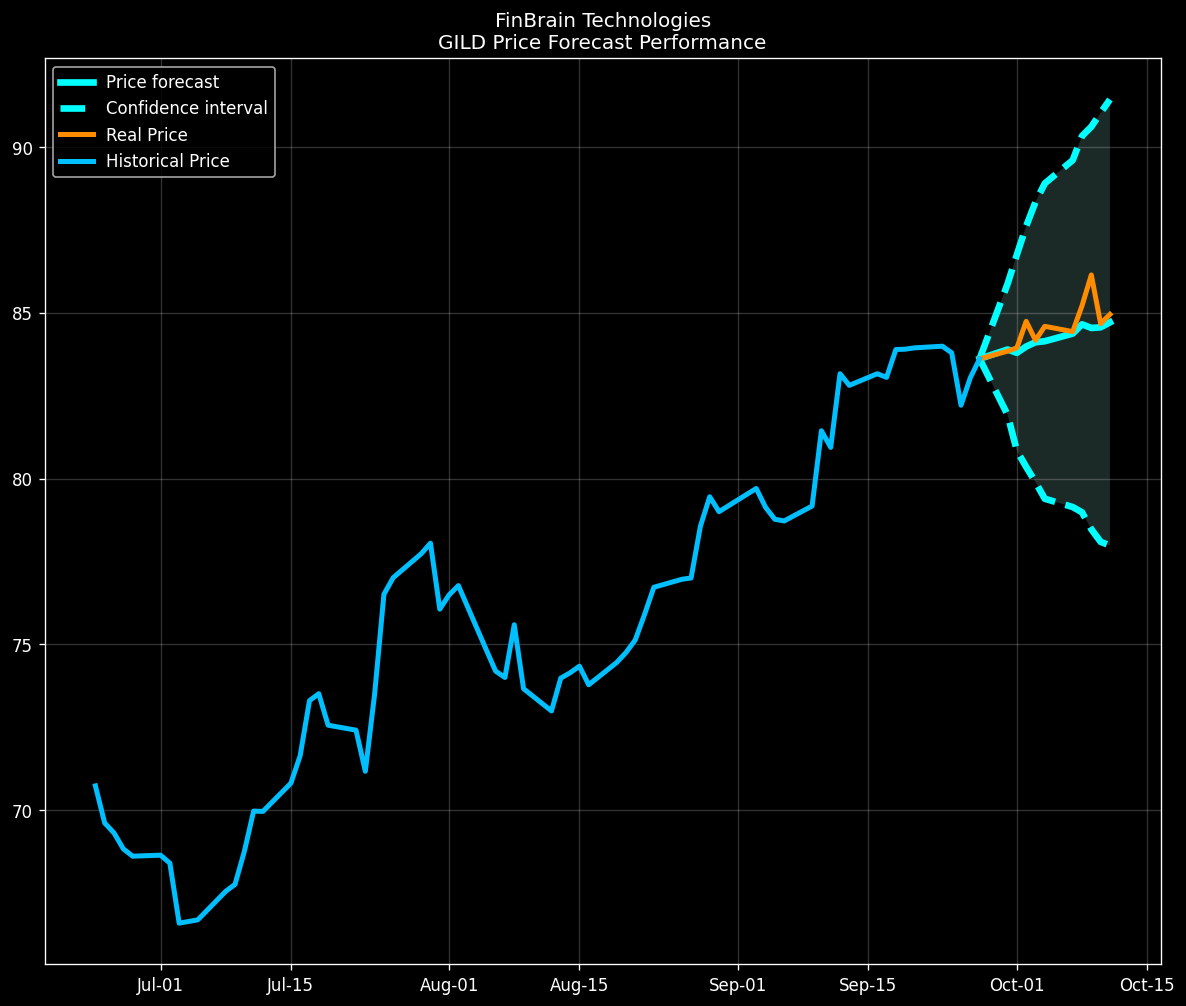

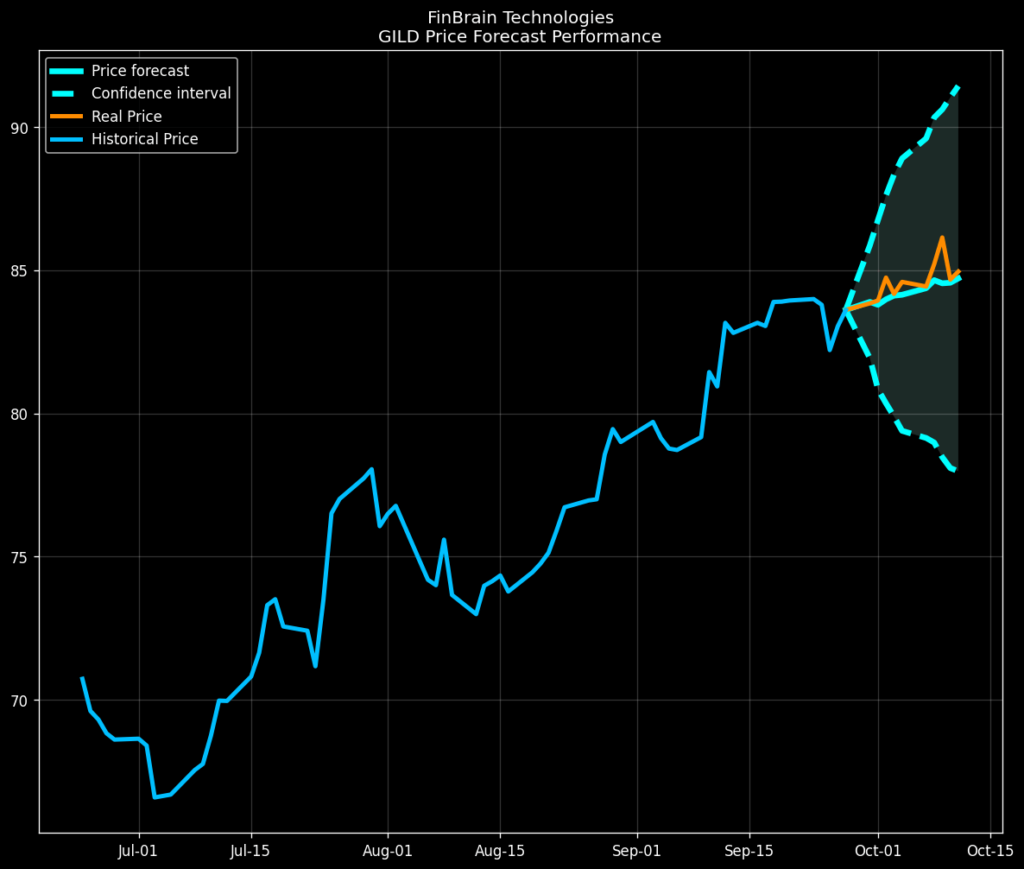

For the period between September 30, 2024, and October 11, 2024, FinBrain’s AI algorithm provided a 10-day ahead price forecast for GILD stock.

At the close of trading on September 27, 2024, GILD’s stock price stood at $83.61. FinBrain’s model predicted that the stock would rise to $84.71, representing a projected gain of 1.32%.

By the end of the forecast period, the real closing price for GILD was $84.95, a 1.60% increase—remarkably close to the forecasted change.

FinBrain’s AI stock forecast accurately captured GILD’s price movements, with the stock staying within the 95% confidence interval throughout the period.

This high degree of accuracy demonstrates the robustness of FinBrain’s predictive algorithms and the value of leveraging AI in the investment decision-making process.

Importance of News Sentiment and Put-Call Ratios

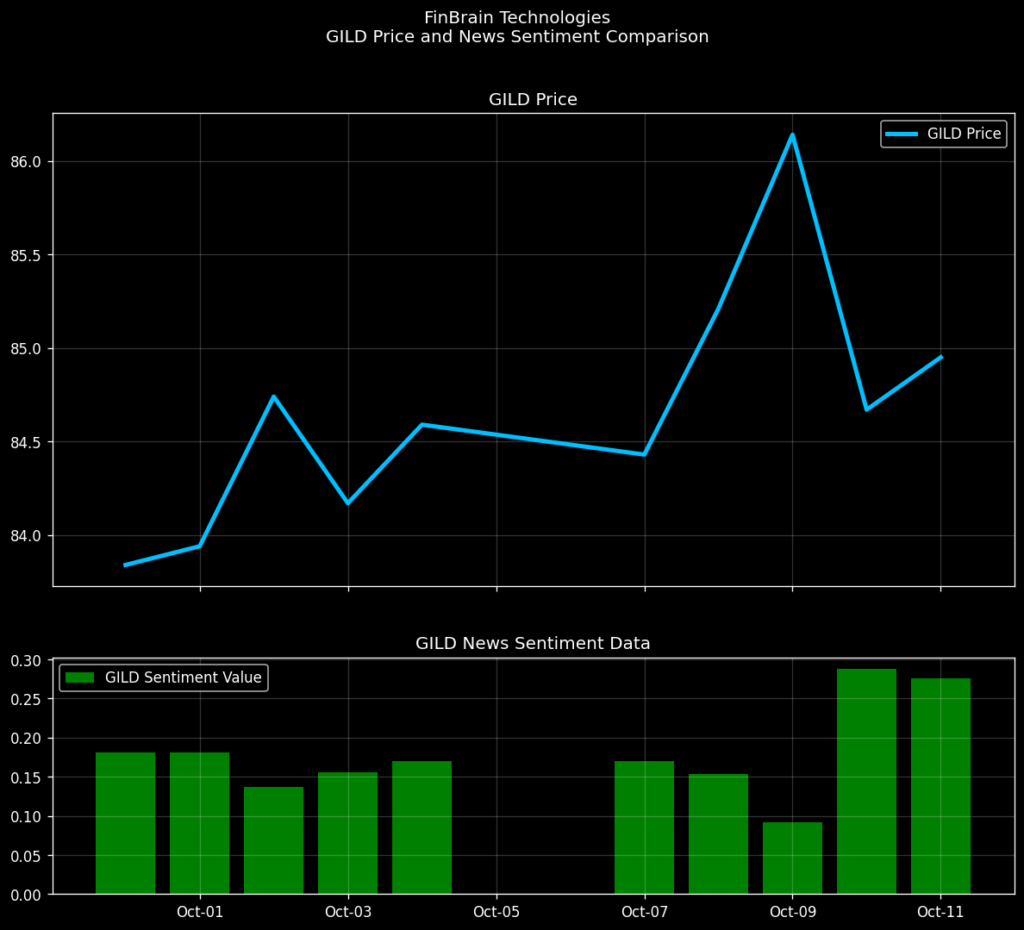

In addition to price predictions, FinBrain leverages alternative data to enhance the precision of its forecasts.

For GILD, news sentiment remained positive during the forecast period, suggesting that media coverage was aligned with a favorable outlook for the stock.

Positive news sentiment often leads to bullish market behavior, which can be a powerful signal for investors.

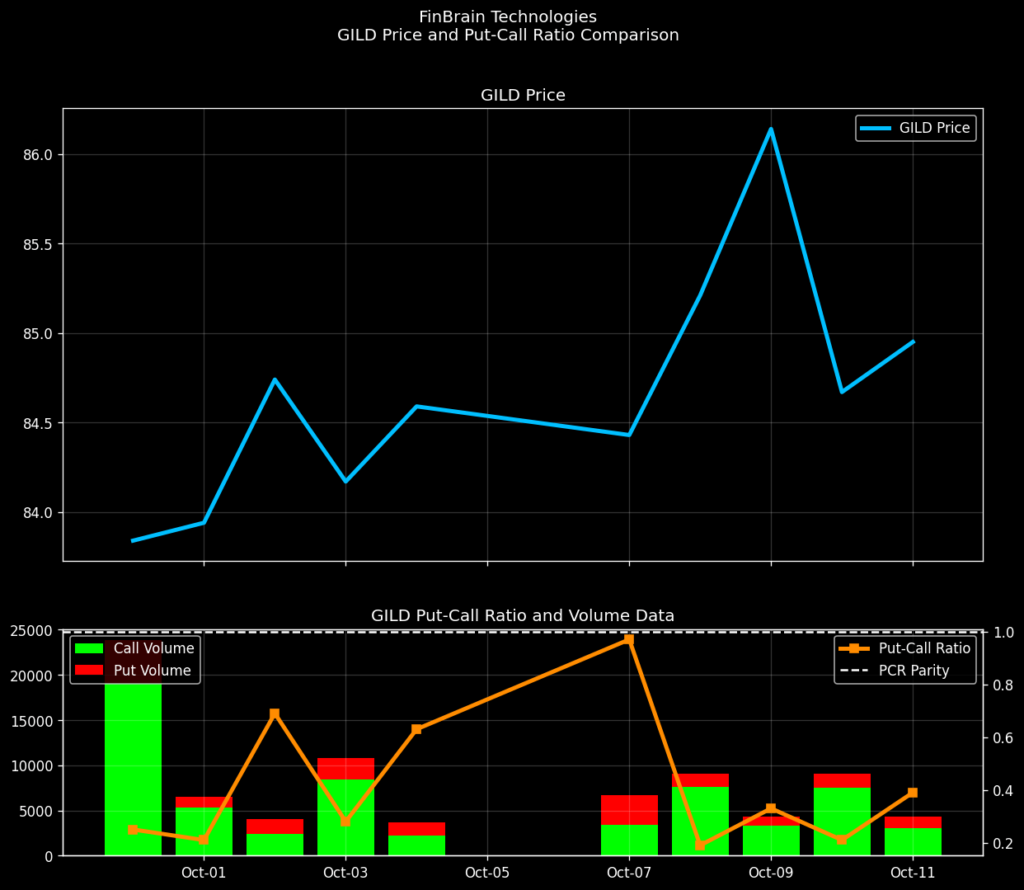

The put-call ratio for GILD was also below 1, indicating that more call options were traded than put options.

This suggests that traders had a positive expectancy for the stock, further supporting the price increase forecasted by FinBrain.

These alternative datasets provide actionable insights that investors can use to make informed decisions, beyond traditional technical and fundamental analysis.

Confidence Intervals and Risk Management

One of the standout features of FinBrain’s predictions is the incorporation of confidence intervals, which help investors understand the potential risks associated with stock movements.

For GILD, the stock’s price movements stayed within the 95% confidence interval for the entire forecast period, underscoring the accuracy of FinBrain’s model.

Moreover, 84% of the tickers listed under the S&P 500 remained within the confidence intervals given by FinBrain’s forecasting model for 8 days or more during the same period.

This level of precision is a testament to how statistics and mathematical models are being integrated into AI-based financial forecasting, providing investors with a clearer understanding of the risk-reward trade-off.

Conclusion

The ability to predict future stock prices and identify market trends using AI algorithms and alternative datasets gives investors a significant edge.

The GILD stock forecast case study exemplifies how FinBrain’s predictive models closely track real-world stock movements, staying within the projected confidence intervals.

At FinBrain Technologies, we are dedicated to helping investors maximize their returns with our AI-generated stock forecasts and alternative financial data.

Explore more about our offerings on the FinBrain Terminal, where you can access AI stock forecasts and alternative data to inform your investment decisions.

Institutional traders and data-driven funds can also leverage our comprehensive datasets through the FinBrain API.

Ready to start your AI-powered investment journey? Visit FinBrain and unlock the future of investing!

FinBrain Technologies