Alphabet shares declined 6.6% after hours on Oct 25, after the release of the quarterly earnings report. And the results were definitely not satisfying.

Alphabet’s revenue growth is decelerating, as the revenue growth slowed to 6% from 41% a year earlier. The company is growing at its lowest rate since 2013.

YouTube advertising revenue came up $400 million short of estimates, which was down 2% to $7.07 billion from $7.21 billion a year ago.

Digital advertising is slowing down as the consumers and businesses are pulling back on spending at a time of rising inflation.

Earnings per share(EPS) came in at $1.06, which was way below the analysts’ expectations of $1.25 per share. Please also note that, Alphabet’s EPS was at $1.40 during the same period last year.

Would it be possible to forecast the lower revenue growth and the decline in Alphabet share prices beforehand?

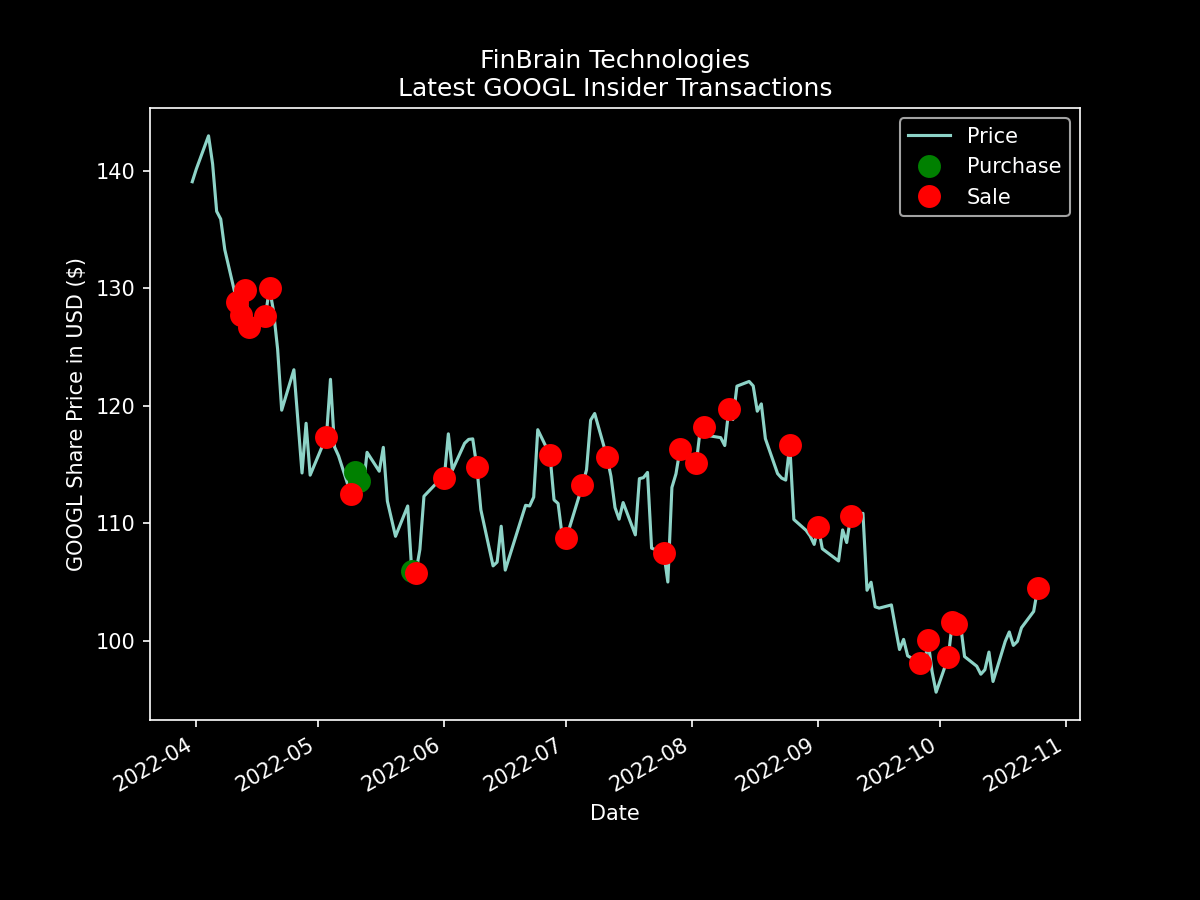

A single dataset was indicating that the company’s managers were losing hope and selling vast amounts of shares over the past couple of months.

Alphabet insider transactions data has already been signaling the decline in GOOGL stock price during the previous months.

Since mid-April this year, the company insiders including Larry Page, Sergey Brin and other company directors have sold $468M worth of GOOGL shares.

During the same period, company insiders have only purchased $12M worth of GOOGL shares, which was a strong indication of an expected downward move in Alphabet share prices.

The total USD value of insider sales was almost 40x more than the total amount of insider purchases during the past 6 months.

By looking at the heavy insider selling activity in Alphabet, one could easily conclude that the company executives and large shareholders were not optimistic about the stock.

The earnings report released on Oct 25 has also validated this idea, as Alphabet share prices have declined more than 6% afterhours.

How can you take advantage of the alternative data as an investor?

Explore the AI Stock Predictions, News Sentiment Scores, US Congress Members’ Trades, Company Insider Transactions, Mobile App Scores, Options Put-Call Ratios and Analysis Reports for 4500+ US Stocks and ETFs on FinBrain Terminal.

We have been posting articles on how the alternative datasets on FinBrain Terminal are sending out accurate signals about the large price movements in stock prices, and how you can take advantage of the data on your investments.

Data driven investing is the future, and you can start leveraging the power of the alternative datasets by visiting FinBrain’s website today.

FinBrain Technologies

99 Wall St. Suite #2023, New York, NY 10005