Lockheed Martin(LMT) third quarter earnings were better than expected and the stock gained 8.7% on Oct 18, after the release of the earnings report.

Lockheed said that it will buy back more shares(twice the prior forecast for the year) and investors loved the idea.

Despite the fact that the LMT investors had a tough time in 2021, the stock is up almost 22% YTD while the S&P500 index is down more than 22% YTD.

A solid 3rd quarter, the company’s exposure to the defense industry and increased buyback pleased the investors and sent the shares soaring almost 9% yesterday.

Did the market send the signals of a positive expectancy in the LMT stock beforehand?

The answer is yes. If you knew where to look and followed the alternative data, you could very well spot the signals of an increase in the LMT stock price before the earnings report was released.

The news sentiment score for the LMT stock was in the positive territory for the last 2 weeks, and we have witnessed a spike in the positive news about Lockheed more than a week ago.

The sentiment score popped to 0.6 a week ago and remained at those levels, which was a strong indication of a positive news sentiment for the LMT stock.

Defense companies benefited from the war in Ukraine and global geopolitical uncertainty. The latest news headlines that FinBrain collected from 20+ sources also signaled the market’s positive expectations for Lockheed Martin.

What did the options data say about LMT stock?

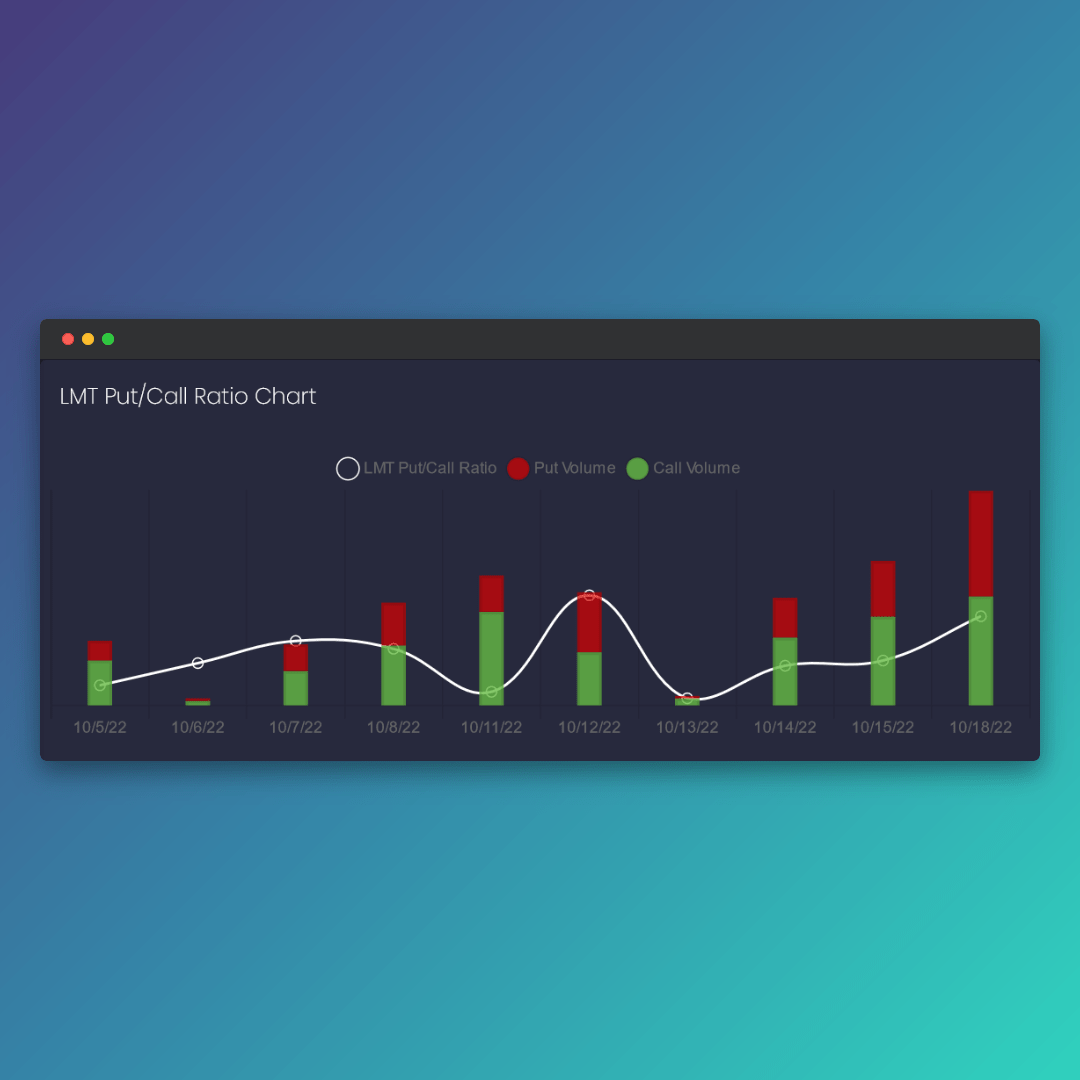

Put/call ratio charts on FinBrain Terminal display the traded put/call option contract volumes and the put/call ratios for the past 2 weeks.

You can dive deep into the options volumes for every single US stock and easily get a glimpse of how the traded options volumes changed for the given time interval.

Both put and call option volumes were relatively low for the LMT stock for the past 2 weeks, however, we have witnessed a spike in the options volumes since the beginning of this week.

Put/call ratio was 0.97 before the market open on the day of earnings, which indicated that the call options(possibility of an increase in LMT stock price) were traded more than the put options.

This dataset also signaled an increase in the options volume and a bullish expectancy for Lockheed Martin’s stock price before the earnings report.

And the strong LMT purchase activities by the US House Representatives…

Latest LMT trades by the US representatives were all purchases. Hon. Scott Franklin, Hon. Kevin Hern and Hon. Diana Harshbarger have all purchased the stock during the past months.

Both of them are up with their positions and it gets more interesting as Scott Franklin is a member of the Committee on Armed Services and Diana Harshbarger is a member of the Committee on Homeland Security.

LMT stock purchase activities by the US House Representatives also indicated that they were expecting a further increase in Lockheed Martin’s stock price.

The data driven investing approach proved its market beating ability once again as we demonstrated the accuracy of the data on FinBrain Terminal with the Lockheed example above.

Datasets on FinBrain Terminal are tabulated and visualized for the ease of use. Our alternative data gives you actionable insights about the stocks and can also be used to cross validate the trading ideas.

There is no better time than now to leverage the power of data driven investing and FinBrain Terminal gives you all the tools you need to start.

FinBrain Technologies

99 Wall St. Suite #2023, New York, NY 10005