As FinBrain Technologies, we are working non-stop to make the alternative datasets available to individual traders.

There is only one approach that can give you the edge over the others in the market and that’s not technicals or fundamentals based investing.

Those methods have lost their alpha generating(market beating) ability long time ago.

It’s almost impossible to generate consistent returns using the indicators or company balance sheets anymore, as those tools are widely available to everyone.

However, there is only one approach that can get you ahead in the markets, which is also heavily used by the large scale hedge funds:

That’s data driven investing.

Once you figure out where to look as an individual investor, you can spot the early signals of an upward or downward move in a stock’s price beforehand.

Do you still think that it’s impossible?

That’s where we come into play as one of the world’s most complete AI and Data Platform for the retail investors.

Let’s take a look at one of the most recent examples of how a company insider’s large scale share buying activity could’ve made you more than 40% within a week.

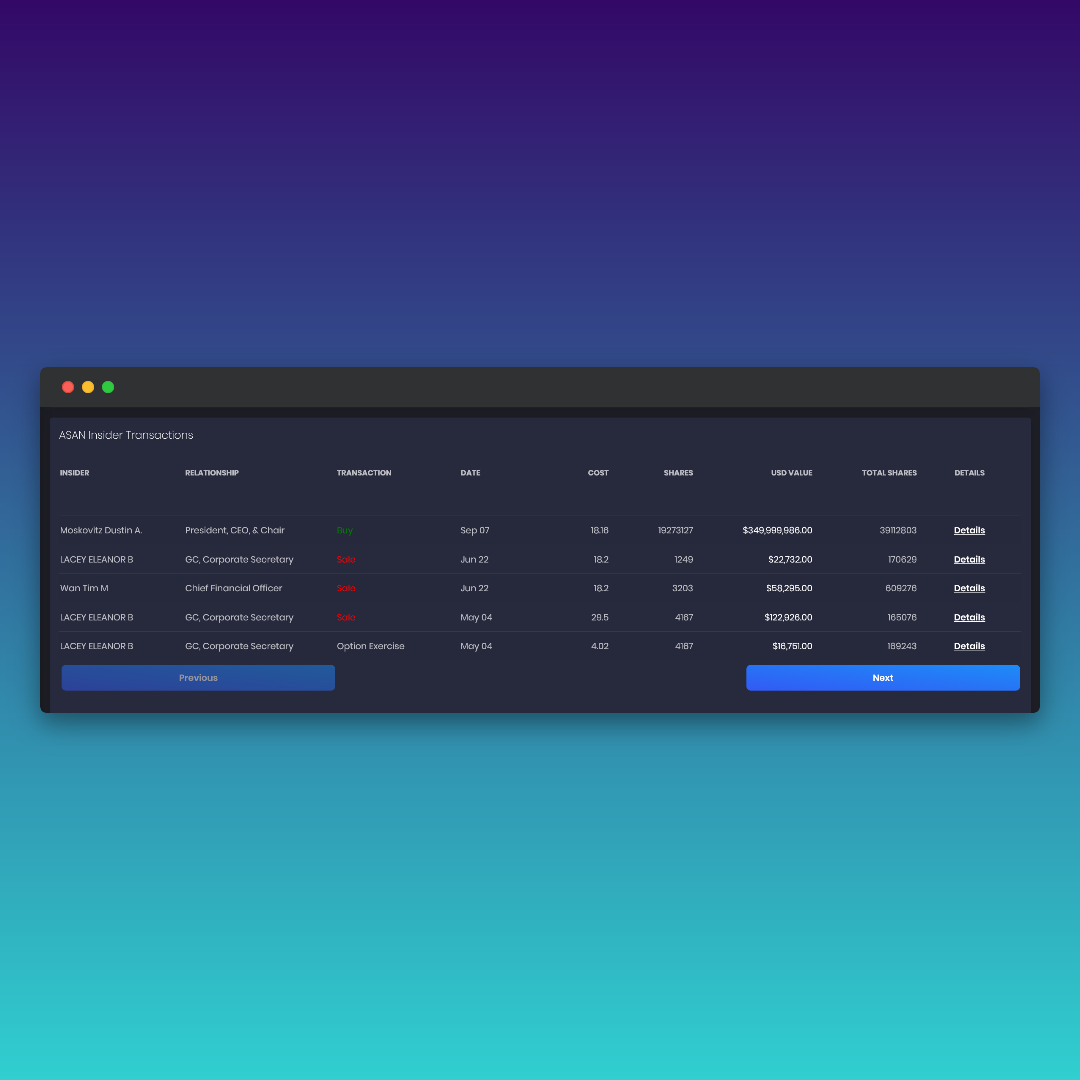

Asana Inc.’s share price has dropped more than 60% YTD. However, a recent insider trading activity by the company’s CEO Dustin Moskovitz has signaled a rally in the stock price.

Dustin Moskovitz purchased 19.2M shares on 07-Sep-2022 at the cost of $18.16. The total USD value of the purchase was massive, he spent $350M on buying the shares of the company he co-founded.

The stock price has hit $28.71 at the close on Monday 12-Sep-2022. That was a massive 58% upward move in ASAN stock price from Moskovitz’s purchase price of $18.16.

ASAN shares are still trading around $26 levels, which is still more than 40% increase since the company CEO’s purchase on 07-Sep.

The latest insider trading activity for each one of 4500+ US stocks are published on FinBrain Terminal on a daily basis.

Dustin Moskovitz’s ASAN share purchase data was also published on Asana Inc.’s ticker page on FinBrain Terminal after the trade was declared on SEC Form-4 on 12-Sep-2022.

We can definitely conclude that it’s a wise move to track the company insider transactions of large share and USD value.

It’s never late to take advantage of the US Congressional Trades, Company Insider Transactions, Sentiment Scores, Put-Call Ratios, Mobile App Scores and AI Stock Predictions to make better informed and data driven decisions in the markets.

Start your data driven investing journey today by visiting FinBrain Terminal.