Bed Bath & Beyond (BBBY) stock has soared as much as 79% yesterday and closed the day up 29%.

Yesterday’s options volume was 2M where the 30 day average was 324k – this is almost a 6x higher options trading activity than usual.

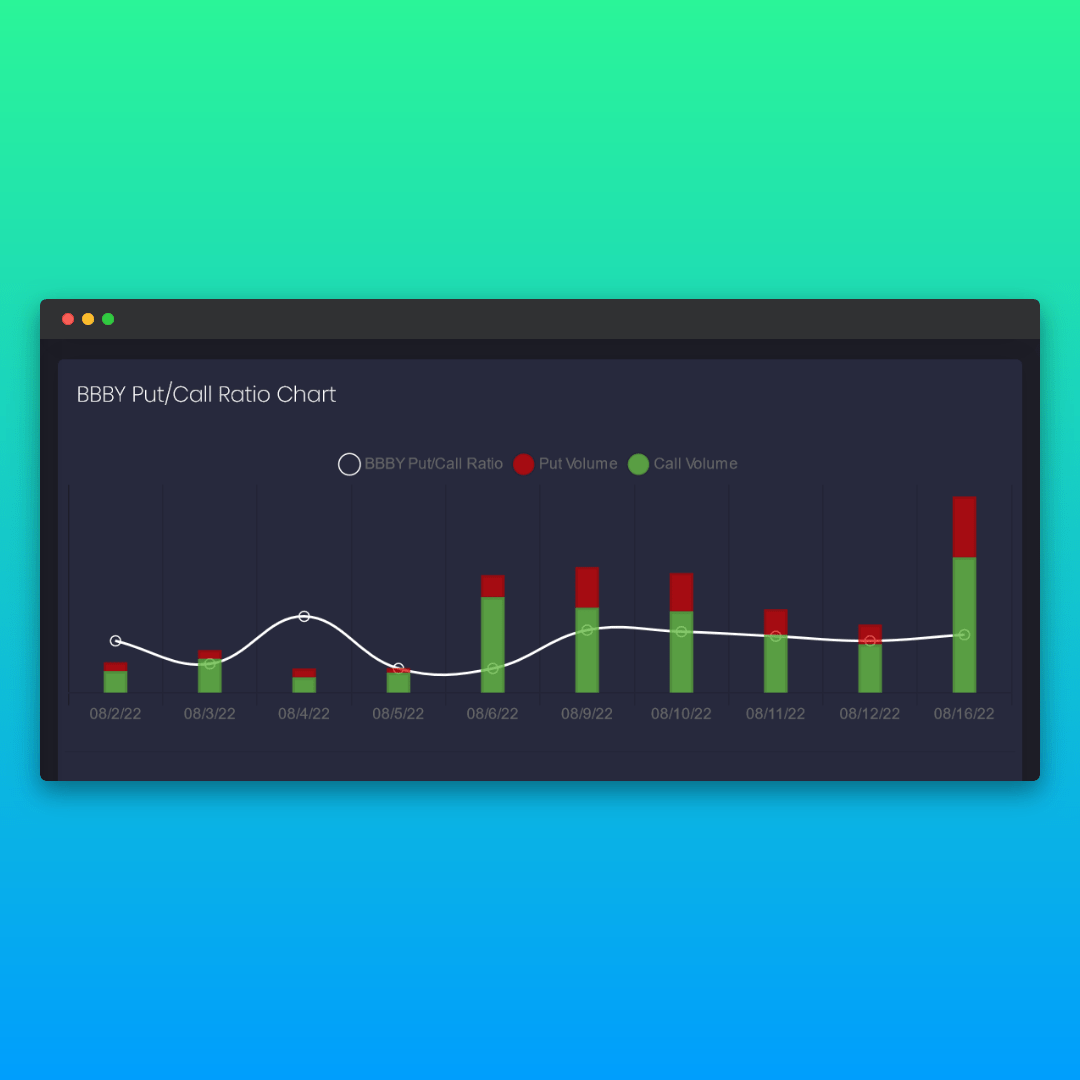

Implied volatility was at 314% and the options put-call ratio was at 0.46 based on the traded volume.

The surge in BBBY stock price was mainly driven by the retail traders’ options buying activity, as clearly seen by looking at the sky-high implied volatility and unusual options trading volume.

Ryan Cohen’s venture capital firm RC Ventures bought deep OTM calls on more than 1.6M BBBY shares, which was followed by the retail traders’ meme stock buying wave.

Insider traders’ buying activity also has significantly increased before the end of July for Bed Bath & Beyond, which can be seen on the Insider Transactions section of BBBY page on FinBrain Terminal.

Despite the fact that the news sentiment was negative about BBBY, the stock’s sentiment score was increasing and entered into the positive territory recently.

BBBY was also among the most mentioned stocks on WallStreetBets community for the last two weeks already.

The number of BBBY mentions was growing everyday and it has even surpassed the retail trader community’s favorite AMC and GME stocks.

FinBrain publishes the most mentioned tickers data, high short interest stocks data on Twitter as well as detailed reports including options activity for these stocks on FinBrain Terminal.

Put-call ratio chart for BBBY on FinBrain Terminal also indicated that the call options were heavily traded. BBBY Technical Report also indicated a significant increase in the Implied Volatility and total Options Volume.

The technical report also indicated that the IV rank is at 100%, which means that the Implied Volatility for BBBY is at its highest level over the past 1-year.

The short interest for BBBY stock was at 47% – which indicates that a high portion of the total float is shorted by the hedge funds.

Ryan Cohen and the retail traders spotted this as a potential short squeeze opportunity and the retail traders’ stock and call options buying activity for BBBY skyrocketed the share price.

CNCB’s Jim Cramer (deep relations with the hedge funds) also became extremely bearish on BBBY last week and the stock is up more than 100% since then.

A data driven approach that captures the company insider activity, options trading activity and the retail community’s most favorite stocks is the new way of investing.

FinBrain posts the data for most mentioned tickers on WallStreetBets, on Twitter twice a day.

You could have easily spotted the growing number of BBBY mentions among the retail traders and spot the bullish movement beforehand by looking at the options data on BBBY Technical Report and Put-Call chart under FinBrain Terminal.

The opportunity to ride the wave that was created by the retail traders – not the hedge funds – presented itself and the data driven investors took advantage of the early signals of this movement beforehand.

Just like in the case of AMC and GME, the retail traders started squeezing the hedge funds on their short positions and turned the direction of the money flow to themselves.

Retail traders are the strongest they’ve ever been and this is your time to exploit the opportunities in the markets by following the right type of data.

Visit FinBrain Terminal today and start your journey to become a data driven investor in the markets and don’t forget, we are here to support you with the cutting edge stock data analysis tools.