META shares are down 50% YTD and the things are not going well for Zuck as META is steadily losing its users and ad revenue.

Meta (Facebook) shares plunged 6% yesterday on revenue and earnings miss and they also lowered guidance for Q3.

Would you be able to spot the earnings miss and the drop in META stock price?

The answer is: definitely yes!

Let’s take a look at some data from META stock analysis page on FinBrain Terminal.

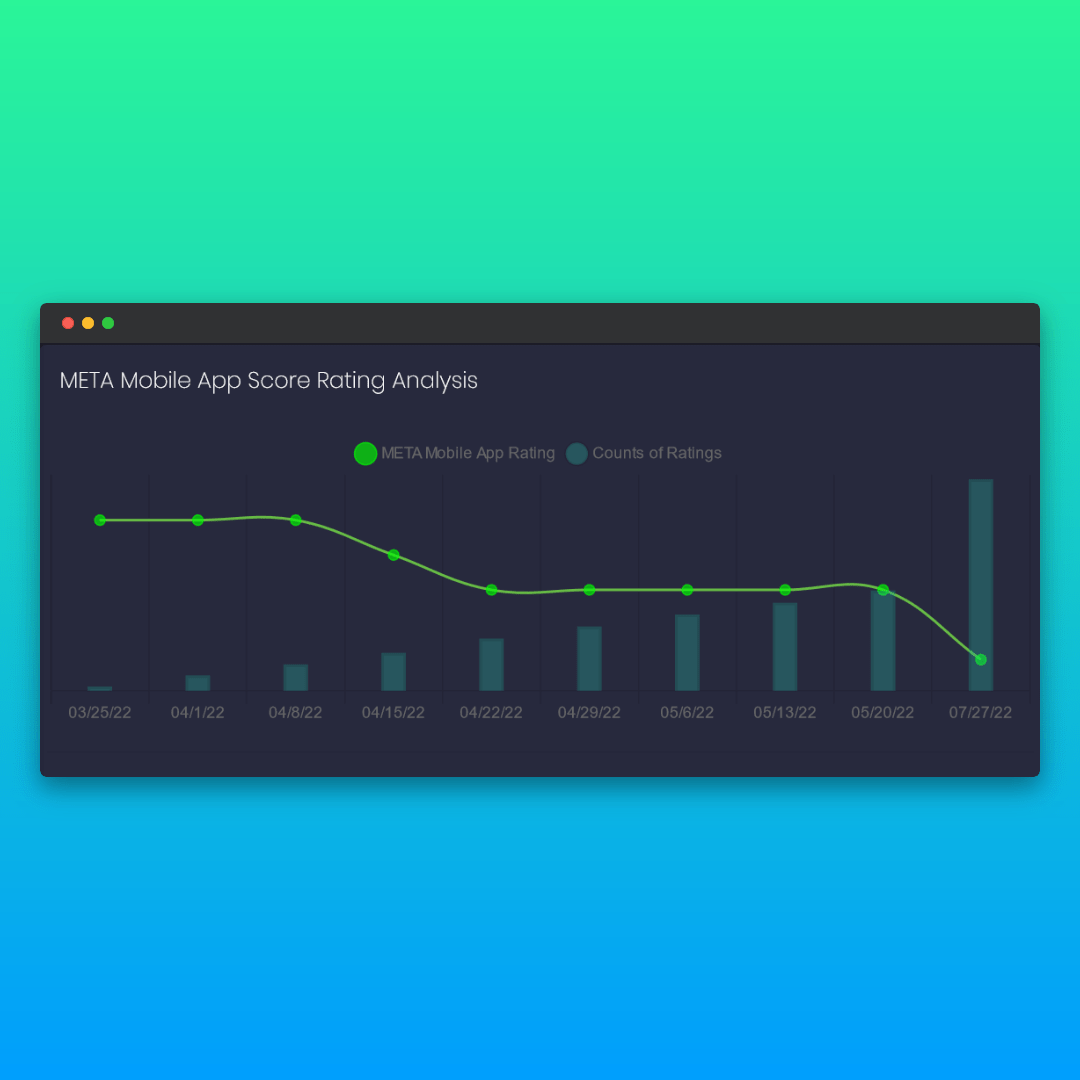

META App Scores were in a clear decline

META app scores were in a constant decline over the past weeks and months.

The latest data we collected from the Android app store indicates that the Facebook app rating has dropped to 3.11 on 27-Jul-22.

The app rating was in a clear decline for the last couple of months and the data indicates that the users were not happy with the app at all.

As META’s business is mostly set around its users and its mobile apps, and with Facebook being its flagship, we could anticipate that the app ratings are in a direct relationship with its revenue and earnings.

The app scores dataset is represented on the charts under FinBrain Terminal for hundreds of US companies that have apps available.

And the dataset can be used as a leading indicator to forecast the earnings performance of a company that set its business around mobile services.

You can basically check how the app ratings & app rating counts have evolved over the time and figure out if the users are happy with the company’s mobile services or not.

If the app rating indicates a steady upward move, we can clearly say that the users are happy with the app and this can lead to an increase in the company’s earnings figures and vice versa.

META Insiders were selling their shares recently

When we check the Insider Transactions section under the META analysis page on FinBrain Terminal, we can clearly see that the latest insider trades were all sales by the company’s Chief Legal Officer Jennifer Newstead.

The dataset usually indicates that the company insiders are selling their shares partially and over the time to fly under the radar and to cash out some amount of their holdings before things go south.

In this case, META’s latest insider trades were signaling an expected drop in its share price, as the latest insider trades were all sales by a C-level executive over a few months.

META News Sentiment Scores were fluctuating around zero

The news sentiment scores for META Platforms were sending mixed signals over the past 10 days as seen on the sentiment scores chart image taken from FinBrain Terminal.

Articles about META did not indicate a clear sentiment, however, the data collected on 27-Jul-22 before the market open indicated a stronger negative sentiment right on the day of earnings release.

The sentiment score was at the negative territory with -0.17, which indicates that the market was expecting a bitter earnings report.

Alternative Datasets can be used as a leading indicator

By using the META’s latest drop following the earnings miss as a fresh case study, we can clearly say that the alternative data for stocks have the predictive ability and can be used a leading indicator.

FinBrain Technologies collects and serves alternative financial data on a daily basis for a universe of 10.000+ assets listed under US&World Stock markets, Index&Commodities Futures and Foreign Exchange markets.

You can take advantage of the AI generated predictions and alternative datasets to make better informed investment decisions by visiting FinBrain Terminal.

We wish you a successful trading week.

FinBrain Technologies

99 Wall St. Suite #2023, New York, NY 10005