Here is why fundamental and technical analysis won’t make you any money

For many years, traders and investors were making decisions based on fundamental and technical analysis.

They were trying to read and understand company fiscal reports, balance sheets or drawing lines on a charting software to anticipate which direction a specific stock’s price will move to.

People are still trying to make money in the markets by looking at the technical indicators that have lost their alpha long time ago.

Backtests involving technical indicators for a large universe of stocks have proven that, none of the widely available indicators or technical analysis techniques have a predictive ability in the long run.

There is also another fact that only 5% of the day traders are able to make money in the stock markets consistently, while the remaining 95% are losing money.

Hedge Funds have a massive edge over the retail traders in the markets

Hedge funds and large scale institutions however, have the informational, computational and technical advantage over the rest of the investors and traders in the markets.

They are able to hire the top talent, build the fastest computer infrastructure and create superior models on top the large scale datasets they have.

These funds are collecting and analyzing the datasets that are not widely available to the retail traders.

Analyzing the news, options flows, insider transactions and many more datasets for the purpose of predicting where the stock prices are heading to, is giving them a massive edge over the others in the financial markets.

Algorithms that forecast the stock prices using Artificial Intelligence are among the most powerful weapons these hedge funds have.

Building machine learning models to analyze the stock prices and other alternative datasets is the best way to handle large scale financial data for the purpose of making better investment decisions.

While PhDs, data scientist and statisticians are constantly working on creating and fine tuning Machine Learning models to get better inferences and forecasts, the retail traders are still going after the old school techniques they think that will give them an edge.

Markets are so complex that they cannot be analyzed by relying on a single indicator or a single dataset. Hence, the investors need more complex models that can examine multiple feature sets at once and generate meaningful inferences.

Prices of different asset classes such as stocks, commodities, index futures and foreign currencies are affected by different factors. Therefore, each of these asset types need large scale models and datasets to be understood and interpreted correctly.

FinBrain democratizes retail traders’ access to AI and Alternative Data

The hedge funds have an unfair advantage over the retail traders in the markets, in terms of analyzing and forecasting the asset prices.

And retail traders are clearly lacking the tools, datasets and systems that can help them understand the market dynamics better.

That’s the reason why we decided to democratize the access to data and AI technologies in investing space.

FinBrain’s team of engineers have created cutting edge AI algorithms that analyze large scale datasets and forecast the prices of the US&World stocks, commodities, index futures and foreign currencies on a daily basis.

We have created the ultimate platform for the traders and investors who are looking to take advantage of the latest data and Machine Learning technologies in their investment decisions.

Our team has created the news sentiment scores dataset, where the algorithms are collecting the news data for 4500+ US Stocks and ETFs on a daily basis and analyze the news sentiment polarity using Artificial Intelligence models.

We are also collecting stock options contracts’ put-call volumes and calculating put-call ratios to bring together a datasets, that will give the traders an edge to see if the options traders are bullish or bearish for a given stock.

Our Artificial Intelligence algorithms are learning from these datasets and are generating the most accurate stock forecasts that a trader can rely on.

Our team has created and perfected Machine Learning models for stock prediction, on top of the datasets which were not publicly available to the retail investors before FinBrain.

FinBrain Terminal also contains Company Insider Transactions, Analyst Ratings, US House&Senate Members’ Trades and mobile app scores datasets, where the traders can interpret these datasets as leading indicators and make better informed investment decisions.

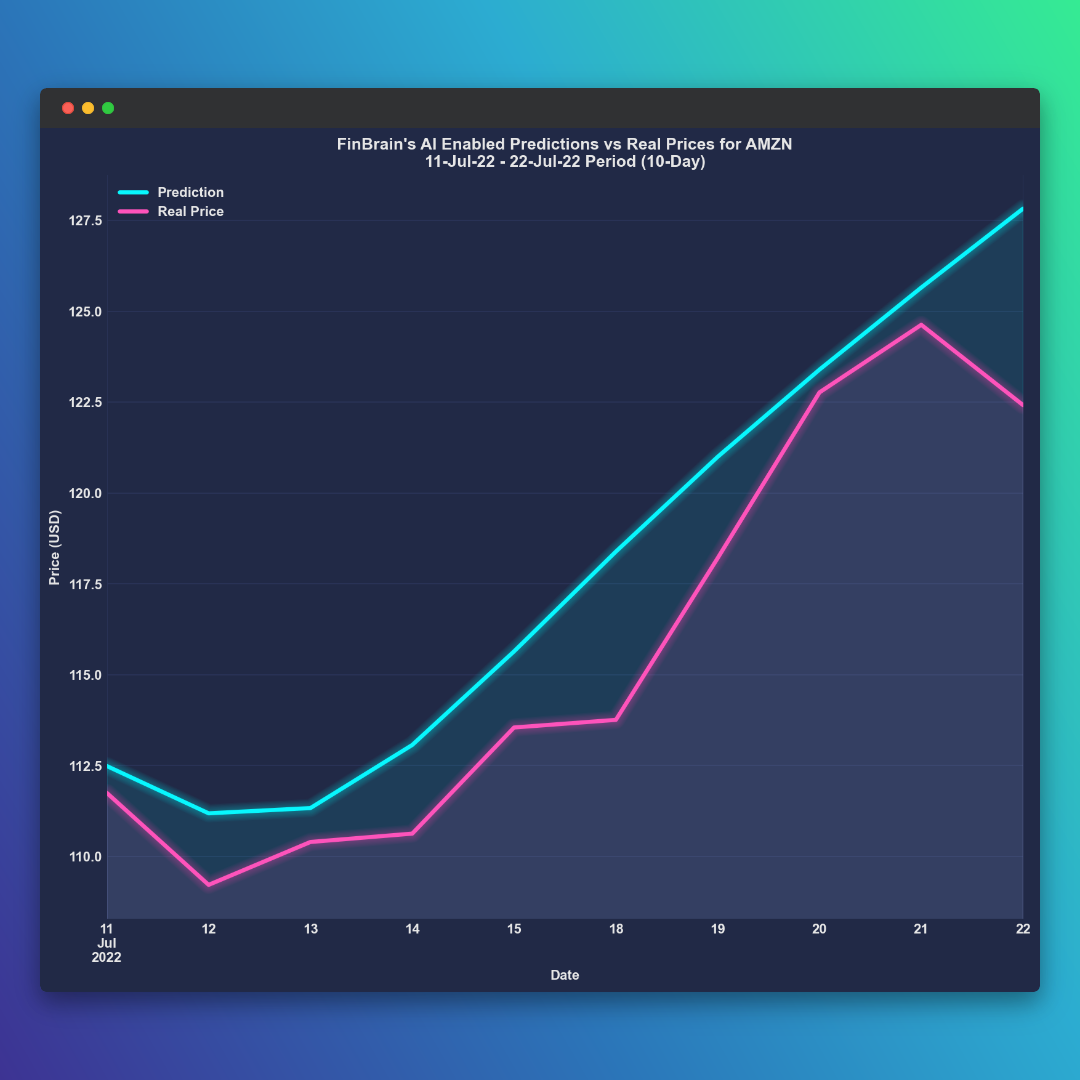

Forecasting the 10 day ahead price move of AMZN Stock using AI and Alternative Data on FinBrain Terminal

We would like to demonstrate how our Deep Learning model has performed in predicting AMZN stock price for a 10 trading day period. Please note that these predictions were published under AMZN stock forecast and alternative data section on FinBrain Terminal.

Our algorithms collect the financial datasets after the markets close everyday and our Artificial Intelligence models analyze these datasets to generate 10 day ahead forecasts to be published on FinBrain Terminal.

Forecasts for 10.000+ US&World stocks, commodities, futures and foreign currency pairs are made available on FinBrain’s website everyday before each market’s open hour.

Traders from 160+ countries are utilizing the alternative data tables, charts and AI generated predictions on FinBrain Terminal to have an informational edge over the other traders in the markets.

AMZN stock has closed the trading day at 115.54 on 8-Jul-2022. Our Machine Learning algorithms have predicted a 10.63% upward move in AMZN within a 10 day period.

Put-call ratio for AMZN was at 0.73 after Friday’s close, which was an indicator that the options traders were trading the possibility of an increase in the stock price, as the call volume was larger than the put volume.

News sentiment polarity was at the positive side with a sentiment score of 0.28 for Amazon.com Inc, which was validating the positive sentiment of the market for AMZN.

AI generated stock forecasts, put-call ratios and news sentiment scores yield the best stock prediction performance when used together to get a validation.

In this case, both datasets are confirming that a positive expectation was formed around AMZN stock and the stock was ready to make an upward move.

The stock almost exactly followed the forecasted price points by FinBrain’s Machine Learning models where the 10 day ahead target price for AMZN was 127.83 and the stock closed the day at 122.42.

As you can see on the chart, our AI algorithm has modeled and captured the price movement between 11-Jul and 22-Jul with a remarkable performance, as the real and predicted prices have almost followed the same path.

The Normalized Mean Squared Error(NMSE) between the predicted and real prices for AMZN is also calculated to be extremely low at 0.414, which indicates that the AI algorithms have made a pretty good job in generating inferences from the datasets we collected.

FinBrain Terminal: Created for the traders, by the traders

FinBrain Terminal is a whole data and artificial intelligence platform created for the traders by the traders. The data published on FinBrain Terminal gives the traders the informational advantage that they were seeking.

Data and AI are the future of investing and the prediction results for AMZN stock we shared above can easily confirm that. FinBrain is the ultimate go to stock data analysis and research platform for the retail traders. You can explore AI generated predictions and Alternative Data for more than 4500 stocks and ETFs listed under NASDAQ, NYSE and ETFs markets on FinBrain Terminal, as well as the World Stocks, Commodities, Index Futures and Foreign Currency Pairs.

Start your journey to become a data driven investor and enjoy making consist returns with FinBrain.

We wish you a successful rest of the week.

FinBrain Technologies

99 Wall St. Suite #2023, New York, NY 10005