Hi from FinBrain Technologies,

We would like to give you a quick update about NFLX – Netflix Inc.’s 26% plunge during the aftermarket hours on Apr. 19, 2022.

The company has reported a loss of 200.000 subscribers during the first quarter.

Could you access these numbers beforehand? The answer is no.

But…

Did any other types of alternative data signaled a downward move on NFLX stock beforehand?

The answer is a “double yes”.

The market expected a drop in NFLX stock price ahead of the first-quarter report.

The Put-call ratio based on total traded volume was 2.34 and based on total open interest was 1.28. This data was provided on FinBrain Terminal’s NFLX stock predictions page on Apr.19 before the market open.

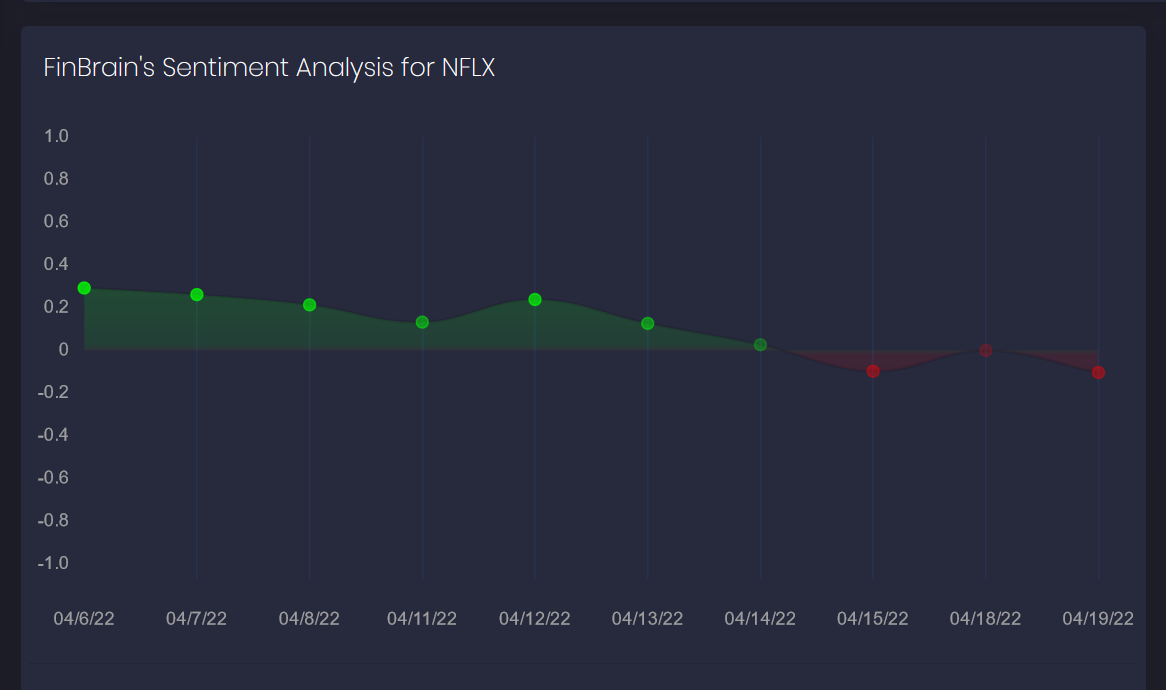

In addition to the bearish put-call ratios, the stock’s daily sentiment scores were in a clear decline during the past 7 days.

Apr.19’s news sentiment data for NFLX published on FinBrain Terminal before the market open was -0.10, which was in the negative territory.

It was obvious that a downward move was expected in NFLX stock price ahead of the first quarter results and you could capture that by looking at the data on FinBrain Terminal.

You can explore various types of alternative data for 10.000+ assets on FinBrain Terminal to gain a massive edge over the others in the markets.

We wish you a successful trading week.

FinBrain Technologies