Automated trading systems are being used by many traders as well as investment firms. The use of trade robots has grown into a multi-billion dollar business.

This is because there have been more advancements in the software, hardware and algorithms that power these automated systems. Furthermore, it is now easier to set up an automated trading system and access markets than ever before.

The following are the main reasons why most traders are turning to AI for their trading needs:

1. Reduce the human error factor

The biggest reason why traders are turning to AI is because of the reduced risk of human error. There have been many high-profile cases where a trader’s decision resulted in the loss of millions or even billions of dollars for their firm. This is not only bad for business but also for morale as well. Even if you do get away with one mistake, it will limit your trading options and lower your profit potential when dealing with large sums of money.

2. High-speed execution systems and algorithms

In order to compete at the highest levels, firms need to set up a computerized system that executes trades in milliseconds or microseconds based on market conditions at any given time. These trading programs are built on powerful software platforms such as C++ and Java which are highly efficient and capable of executing trades quickly without getting bogged down by slow internet connections or poor data signals due to weather conditions, faulty equipment etc… The same cannot be said for humans who can be easily distracted by other elements during trade execution such as family matters, news reports etc … It takes a lot more than speed to make decisions when you have multiple technical factors involved like price volatility, volume changes, interest rates etc.. A sophisticated algorithm can take these into account while making an appropriate decision within fractions of seconds without wasting time thinking about it like humans do!

3. Round the clock execution and 24/7 access to market data

Humans can only trade during a limited number of hours each day due to work commitments, family issues etc… A computerized trading system is available at all times – 24 hours a day and 365 days a year! They don’t need any sleep or food breaks either (unless you program them that way). This means that traders are not restricted by time zones when it comes to making trades. They can also run back-testing on historical data, test out new strategies or have different scenarios running in multiple markets at the same time.

4. Lower transaction costs and higher profits for traders who trade large volumes of shares or currency pairs

When dealing with millions of dollars worth of assets, even small differences in their price will add up over time into hundreds if not thousands of dollars in additional profit for the trader. An automated trading system will take advantage of these opportunities without getting sidetracked by personal emotion which can be costly especially when dealing with large sums of money. The major difference between human intuition and AI software is that algorithms are less emotional than humans as they do not take too many things into account before making an appropriate decision based on calculated probabilities rather than gut feelings!

5. Reduce the risk of fraud and manipulation in the financial markets

The main reason why most traders are turning to AI is because they believe it will protect them against a potential manipulation by banks, investment firms or other large financial institutions that have access to market data before everyone else does. There have been numerous cases where insider trading has led to losses on behalf of unsuspecting retail investors who were not privy to what was happening within these firms. Advances in computerized trading algorithms can reduce the risk of this occurring, especially when you run multiple scenarios based on historical data, current market conditions and future events at any given time!

How To Use Automated Trading Systems In The Best Possible Way?

Automated trading systems can be very beneficial to traders who are not able to trade all the time due to their work schedule. They also help eliminate the human error factor when it comes to making decisions when dealing with large sums of money. However, in order for a robot trader or automated trading program to take full advantage of these benefits, they must be programmed properly and used in conjunction with other indicators and trading strategies that compliment each other.

The following advice will help you come up with an effective strategy on your own:

1) Set realistic profit targets based on historical data from different market conditions

2) Test out your system on historical data for at least 3-4 months before placing any trades into live accounts

3) Use multiple indicators such as momentum oscillators, support/resistance levels etc.. in order to make more accurate predictions about future price movement

4) Keep in mind that all trading strategies have a chance of failing so you should always protect yourself and your capital by setting stop-loss limits. This will ensure that you can cut your losses if the system fails to perform as expected.

5) Always keep an eye on market conditions such as volume, price volatility and news reports in order to determine if they are suitable for making trades or not. If a breakout occurs during volatile times, it is better to wait until the market has stabilized before making any trades!

6) If possible, set up multiple automated trading systems and compare their results over a long period of time. This way you can determine which ones are performing the best under different conditions and use these as your primary trading programs!

Integrating AI Driven Stock Predictions and Alternative Data Into Your Trading Systems

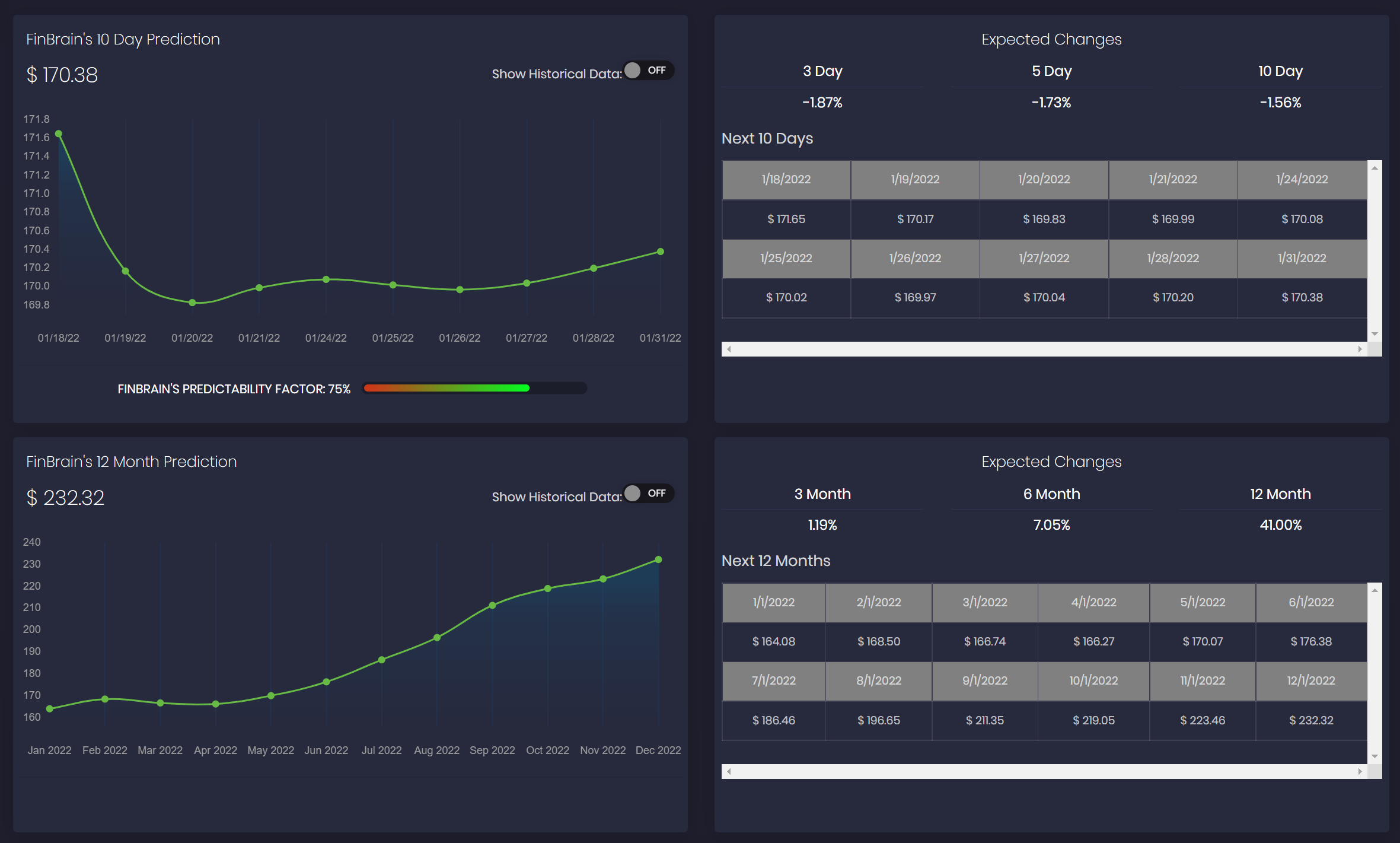

You can also consider using the alternative data feeds that can give you an edge over the others out there in the markets. FinBrain Technologies leverage the power of AI algorithms for stock picking and stock price prediction and help traders from 160+ countries to beat the markets everyday.

Our AI driven tools collect and analyze the historical, fundamental, technical and alternative data from multiple sources, feed them into custom deep learning models and generate accurate stock forecasts.

We also provide our users with the alternative financial datasets such as US Congress member traders, company insider transactions, news sentiment scores and mobile app store scores for thousands of publicly traded US companies.

These datasets and predictions can be used as the predictor feature sets for custom automated trading algorithms.

Visit FinBrain API documentation to discover which AI driven tools and alternative data you can integrate into your own automated trading systems.