Predicting the stock prices and making money in the markets using the traditional methods got almost impossible in the recent years. Markets don’t follow the fundamental or technical rules, hence these methods are falling short to understand and forecast the stock prices. It’s almost impossible to make money consistently or beat the markets by looking at the company financial statements or by drawing lines on the price charts.

How do the smartest guys in the markets stay ahead in the game?

Smartest guys in the markets are utilizing Artificial Intelligence and Alternative Data Technologies to analyze and predict the market movements. Largest hedge funds are developing algorithms that parse through pricing, fundamental, technical, news and alternative datasets to predict where the markets are heading to in the future.

The PhDs in the world’s largest hedge funds are developing technologies to stay ahead of the game and forecast the movements of the financial instruments beforehand. And how do they achieve that? The answer is by using leading indicators and datasets. 99% of the technical indicators or fundamental data available to the individual traders are lagged, which means that they have no predictive ability.

Why should you focus on the leading indicators and datasets rather than the lagged ones?

If you like to take successful trades and achieve a high accuracy in your predictions, you should be looking at the leading indicators and datasets. As the alpha disappears from the traditional pricing, fundamental or technical datasets, it can still be found in the alternative data and AI driven analysis tools.

The alternative financial datasets still have the market beating capability as the underlying information is still waiting to be exploited. The hidden alpha can be found using the Artificial Intelligence algorithms and data mining techniques. The ones who figure out the ways to quantify the qualitative data and feed them into advanced Machine Learning/AI models have the ability to generate accurate signals to predict the future outcomes better than the others.

Alternative Data and AI will give you the edge in the markets

US Congress Members’ trades, company insider transactions, news sentiment scores, publicly traded company app scores and AI driven forecasts published on FinBrain Terminal are some of the greatest examples of the Alternative and AI driven datasets where the alpha lies underneath. If you track these datasets closely, you’ll get the chances of taking steps before the others in the markets and increase your market beating possibilities massively.

A great place to start is the app scores dataset for the publicly traded companies

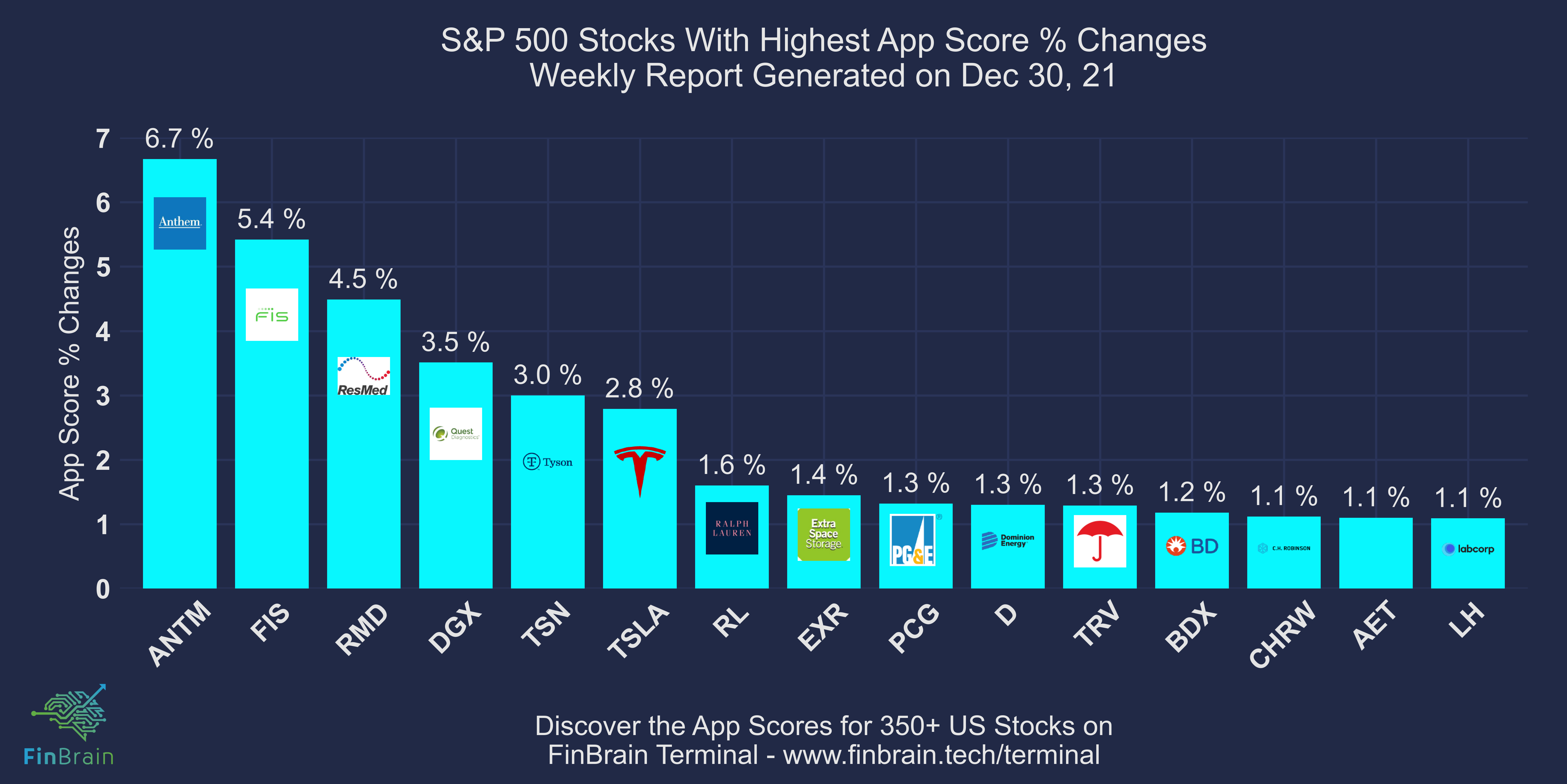

Trading is still a game of beating the others out there, hence you got to act smart and use all the cutting edge tools and datasets in order to get ahead. This week, we would like to share with you the chart of Highest App Score Changes for the Publicly Traded Companies listed under S&P500 index.

FinBrain collects the app scores for more than 350 US companies every week on Fridays. The chart shows the highest app score percentage changes for the company tickers listed under S&P500 between Dec 17-24, 2021.

The app score and app review counts changes can be a leading indicator of how the company will perform for the given quarter. The dataset can be used to forecast the revenue numbers of a given company based on the adoption of their mobile services, especially for the companies in the IT sector. This way, you can look at the app scores dataset as a leading indicator that can have some underlying information about the company’s performance metrics.

Visit FinBrain Terminal to explore how the app scores for more than 350 publicly traded US companies have evolved over time and keep your edge over the others out there in the market.

We wish you a happy new year.

FinBrain Technologies