Hello from FinBrain Technologies!

We would like to inform you that we have enabled the predictions for all stocks listed under Hong Kong Stock Exchange (Hang Seng Index). The package consists of:

• Deep Learning Enabled Predictions for All 1949 Stocks in Hong Kong Hang Seng Index

• 10 Day Ahead Predictions along with Predictability Indicators, provided on a DAILY BASIS

• Automated Technical Analysis Report for Every Single Asset

• Filtering for Highest Return and Highest Predictability Stocks

FinBrain’s 3-Day and 5-Day ETF Portfolio Performances

In this post, we will demonstrate how our ETF portfolios constructed by AI algorithms, performed over 3-day and 5-day periods.

FinBrain’s Deep Learning algorithms have been developed to analyze vast amounts of financial data including daily asset prices, technical indicators and overall market sentiment. The models trained on gigabytes of data then predict the asset price movements for the next 10-day timeframe. Currently, our algorithms collect, analyze and predict the financial data for more than 9000 financial assets listed under S&P500, NASDAQ, NYSE, DOW30, ETFs, Commodities, Foreign Currencies, Cryptocurrencies as well as World Stock Markets UK FTSE100, Germany DAX, Canada TSX and Hong Kong Hang Seng.

A huge variety of traders and investors have been signed up to our services from more than 130 countries all over the world, people from more than 35 countries have already been subscribed to our services and started utilizing our AI-enabled predictions to increase their investment returns.

In this post, we will inform you about the maximum and average percentage returns of our 3-day and 5-day Top Long and Top Short Portfolios constructed by US Exchange Traded Funds.

FinBrain’s 3-Day Top Long ETF Portfolio

The 3-Day Top Long Portfolio Returns have been listed above. DWT – VelocityShares 3x Inverse Crude Oil ETNs has yielded the highest return with 14.83% , where the predicted 3-day change was given as 11.44% by FinBrain’s algorithms. The portfolio’s average 3-day return was 2.52% where the S&P500 has slightly moved 0.3% between 17-19 Sep 2019. The overall signal accuracy was 90%.

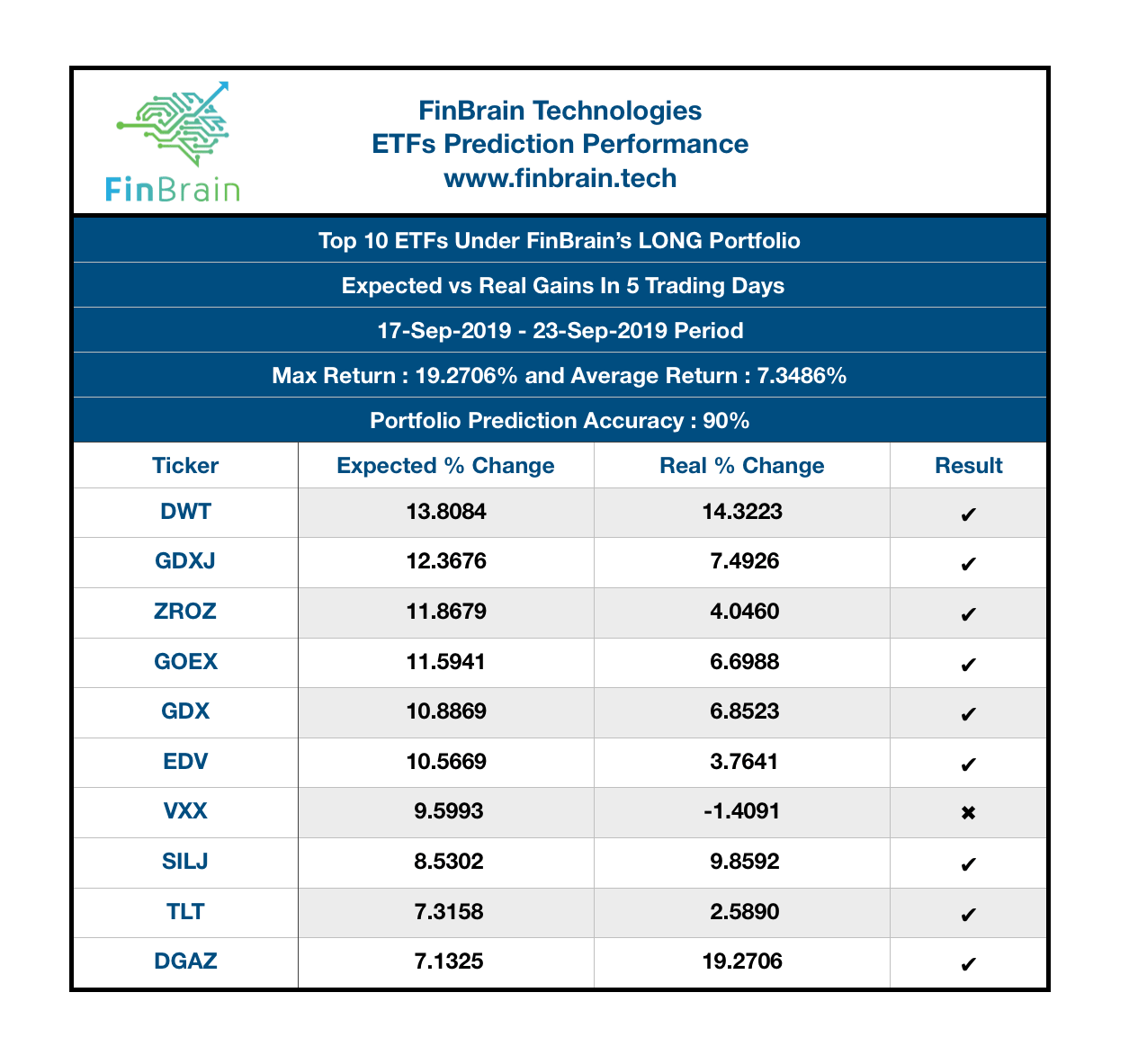

FinBrain’s 5-Day Top Long ETF Portfolio

The 5-Day Top Long Portfolio has returned a massive 7.34% between 17-23 Sep 2019, where S&P500 Index has slightly dropped 0.2%. The maximum return was scored by DGAZ – VelocityShares 3x Inverse Natural Gas ETN with 19.27% change in value. The overall signal accuracy for the portfolio was 90%.

Our algorithms have exhibited a remarkable performance in terms of both percentage change values and signalwise accuracy. Let’s see how our short portfolios have performed for the same time intervals.

FinBrain’s 3-Day Top Short ETF Portfolio

The 3-day short portfolio has exhibited a 100% signalwise prediction accuracy where the predicted vs. real change values were also very close to each other. The top mover under the short portfolio was PXE – Invesco Dynamic Energy Exploration & Production ETF with a 6.23% drop in value.

FinBrain’s 5-Day Top Short ETF Portfolio

The 5-day short portfolio has also exhibited a great 100% prediction accuracy based on the provided signals. The top mover was UWT – VelocityShares 3x Long Crude Oil ETNs with a 14.94% drop in value, where FinBrain has very closely predicted that UWT would lose 8.23% in value.

We definitely suggest you to start utilizing FinBrain’s AI enabled predictions, if you haven’t yet. Our predictions are right on spot regardless of the market conditions and still yield a high signal-wise and percentage-wise prediction accuracy. If you would like to maximize your returns while minimizing risks, FinBrain’s Deep Learning algorithms are going to be a great fit for you. Even in the most volatile market conditions, our algorithms have yielded a remarkable performance.

Sign up on www.finbrain.tech , choose the package of your interest among the 12 available markets and subscribe to our services with 20% off.

We wish you a successful trading week.

FinBrain Technologies