FinBrain Technologies utilizes Deep Learning algorithms to predict the 10 day ahead future prices of the assets listed under S&P500, NASDAQ, NYSE, DOW30, Commodities, Foreign Currencies and ETFs markets. Recently, United Kingdom FTSE100 and German DAX prediction services have been made available on FinBrain’s website.

Our algorithms collect and analyze historical pricing data, technical indicators and the market sentiment to predict the future prices and to select the highest return stocks. Deep Learning algorithms analyze vast amounts of financial data for more than 6000 financial assets listed under the mentioned markets, on a daily basis. The 10 day ahead predictions, predictability indicators, Top Long and Top Short stocks become available for our traders before the markets open everyday.

In this post, we will go through our AI algorithms’ 3-Day, 5-Day and 10-Day Short Portfolio prediction performances for the stocks listed under NASDAQ Index, between 08-Aug-2019 – 21-Aug-2019 period. These predictions were shared with our customers on our website, on 08-Aug hours before the markets open.

3-Day Short Portfolio Performance

NASDAQ Index have moved sideways, and seen no change between 08-12-Aug period. Our Top Short portfolio has achieved an 80% prediction accuracy within this period, as seen on the table. KIRK – Kirkland’s, Inc. has marked the highest loss in FinBrain’s 3-Day Top Short Portfolio with 16.67% drop in its value. HTGM – HTG Molecular Diagnostics Inc followed KIRK as the second stock that lost the most value, with a 14.06% drop in the stock’s price. Our algorithms missed on MRNS and CNAT predictions, however correctly predicted the movement direction of 8 out of 10 stocks listed under the portfolio.

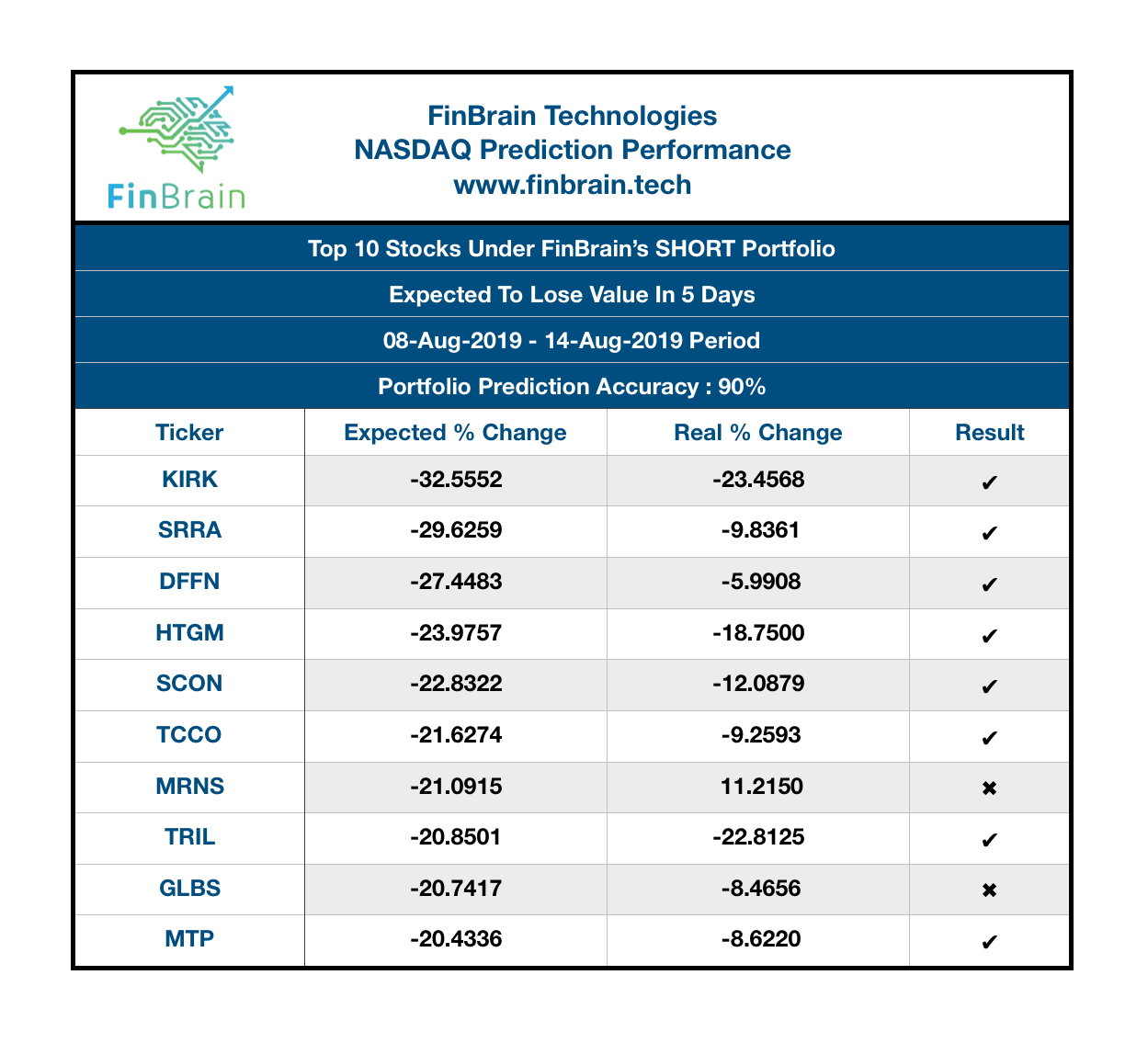

5-Day Short Portfolio Performance

NASDAQ Index has marked a 1.13% drop and S&P500 Index has marked a -1.50% drop in their values between 08-14-Aug-2019 period. Our Deep Learning based stock price prediction algorithms have correctly predicted the movement directions of the Top Short stocks with a 90% accuracy. KIRK has lost 23.45% of its value where the expected change was -32.55% for the given period. KIRK was followed by TRIL – Trillium Therapeutics Inc as the second stock that lost the most value in the portfolio with a -22.81% change in its value versus the -20.85% expected change. So far, the 3-day and 5-day portfolios have performed remarkably during the sideways and declining market periods. Let’s see how we performed on the 10-day period.

10-Day Short Portfolio Performance

NASDAQ and S&P500 Indexes have surged 2.00% and 1.40% during the 10-day period between 08-21-Aug-2019. SCON – Superconductor Technologies, Inc. was the stock that lost the most value in FinBrain’s Top Short portfolio, with a -29.12% change. It was followed by LMFA – LM Funding America Inc. stock which dropped -15.23% during the 10-day period. The portfolio’s signalwise prediction accuracy was 80% where our algorithms have missed its predictions on EMITF and ADRO.

Remarkable Accuracy Despite the Market Conditions

As seen on the results above, FinBrain Technologies has developed a Deep Learning enabled prediction system that performs remarkably well on upward, downward and sideway market movements. Our first priority always is to generate alpha in any market conditions and maximize the returns of our traders. FinBrain’s predictions have beaten the markets once again for different time horizons and helped investors to protect the value of their portfolios. Our algorithms learn from and react quickly to the changes in the market conditions thanks to the Deep Neural Network model that’s been developed to analyze and predict the stock price movements.

If you are a trader or an investor in US, UK, German Stock Markets or Commodities, Forex and ETFs, FinBrain’s algorithms are here to help you on yielding high profits and protecting your position’s value. It’s essential to react to the changes in the market conditions quickly. FinBrain’s AI based tools are going to help you to increase your portfolio’s returns and to cut losses.

Register and subscribe on: www.finbrain.tech

FinBrain Technologies