FinBrain has enabled the ETF Predictions Package a long time ago, and the package performs remarkably well since then. Our AI algorithms analyze and predict the future prices of the top 360 US ETFs. The overall and top portfolio accuracies fluctuate around 80-90% for the majority of the past prediction intervals. The overall accuracy is measured based on the signalwise prediction accuracy of all the assets listed under the ETFs package and the top portfolio accuracy is measured the same way for the top 10 assets listed under the Long and Short portfolios constructed by FinBrain’s algorithms.

High Expected Return ETFs Portfolio Performance

The overall 3-day(15/17-Jul-2019 period) prediction accuracy was 84.17% and 5-day(15/19-Jul-2019 period) prediction accuracy was 80%.

Maximum return was yielded by TUR as 2.46% for the 3-day prediction horizon. TUR – The iShares MSCI Turkey ETF seeks to track the investment results of a broad-based index composed of Turkish equities. TUR is the only fund on the market offering pure exposure to Turkey.

ZROZ has also performed well, with a 2.03% return in 3-day period. ZROZ – PIMCO 25+ Year Zero Coupon US Treasury Index ETF tracks a market-weighted index comprising separate trading of registered interest and principal of Securities (STRIPs), with a remaining maturity of 25 years+. The 3-day expected return for ZROZ was 3.38% and the predictability indicator was provided as 0.86 where the real change value was 2.03%.

The average return of FinBrain’s Top Long ETFs portfolio was 1.16% and the prediction accuracy was 90% for the 3-day prediction horizon.

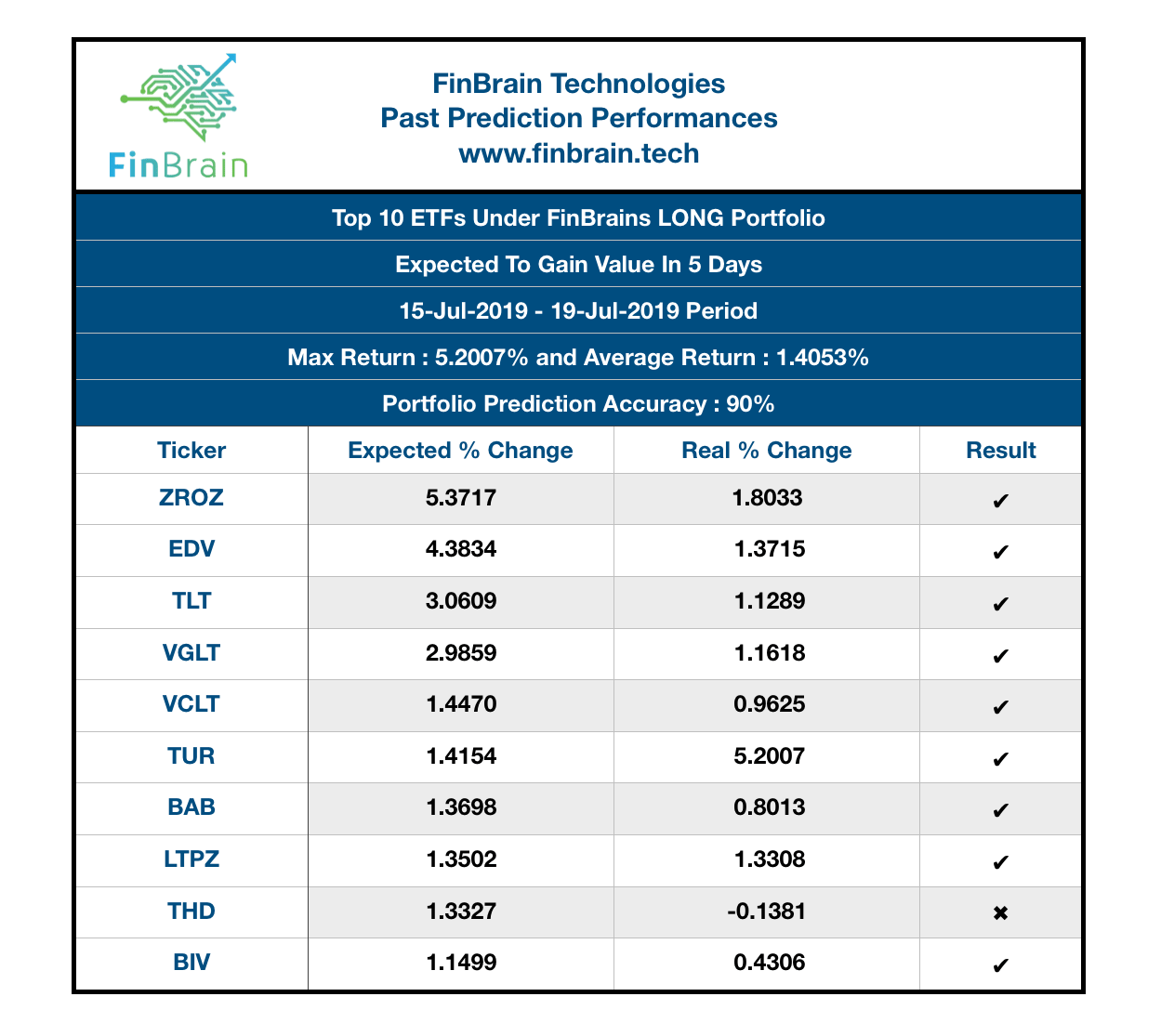

For the 5-day period, TUR was also the top performing portfolio and returned 5.20%. The top long portfolio’s prediction accuracy was 90% and the overall prediction accuracy was 80% for this period. FinBrain has correctly predicted 9 out of 10 stocks in the Top Long Portfolio and 288 out of all 360 ETFs. The average return of the Top US ETFs was 1.40% for this period.

High Expected Loss ETFs Portfolio Performance

FinBrain’s Top Short Portfolio also consists of 10 ETFs that were predicted to lose the most value over the given time periods. GCE has lost the most value with a -6.18% change during the 3-day period, where FinBrain’s algorithms have expected a -4.92% change. GCE – Claymore CEF Index-Linked GS Connect ETN tracks an index of US-listed closed-end funds, aiming for exposure to a high-yield portfolio of closed-end funds with big asset bases and high liquidity, and which trade at attractive discounts to NAV.

RYE was the second worst performing ETF in FinBrain’s Short Portfolio with a 4.68% value loss where our algorithms have predicted a -2.04% change.

GCE has lost 7.81% of its value between 15/19-Jul, and it was the worst performing asset in the 5-day Short Portfolio as well. FinBrain has correctly predicted 8 out of 10 assets under this portfolio to lose value and the percentage value change results were quite close to the expected change values.

The Predictions Data Provided by FinBrain

FinBrain Technologies provides its AI based predictions in the form of price points for the next 10 day time period. Which means that, the results are not provided as bare Buy/Sell signals, but instead as a price direction indicated point-by-point. The fact that FinBrain provides predictability indicators and future price points for the 10 day ahead horizon indicates how confident we are with our AI algorithms and our predictions.

We would like to remind you that our algorithms analyze the financial data and predict the future prices for every single asset listed under S&P500, NASDAQ, NYSE, Dow30, Foreign Exchange, Commodities, Cryptocurrencies and ETFs markets. The whole process requires a huge data collection, processing and calculation power. Our engineers perform research and development activities to incorporate more data and to develop more complex models for the benefit of our customers.

Deep Learning is an AI technique used to map the inputs to the outputs using mathematical representations. In the case of stock price prediction, the inputs fed into the Deep Learning models can be the historical OHLCV data, technical indicators and alternative data where the output is the stock’s price in the next time step. We will explain about the alternative data further in another post. The models learn how the changes in the input values affect the output, by performing a computationally intensive optimization process. FinBrain’s Deep Learning models are optimized for the stock prediction tasks and are running on high performance GPUs.

Our AI based prediction algorithms and high return ETF portfolios help the amateur and professional traders from more than 130 countries all around the world in maximizing returns and minimizing risks. FinBrain’s data driven AI approach is here to help our customers beat the markets. Visit and subscribe on www.finbrain.tech.

Best Regards,

FinBrain Technologies